Business payment refers to the transfer of funds between businesses for goods or services rendered. It encompasses various methods and technologies used to facilitate these transactions, ranging from traditional methods like checks and wire transfers to modern digital payment systems. Business payments play a crucial role in maintaining seamless financial operations and fostering business relationships.

The importance of efficient business payment systems cannot be overstated. They streamline financial processes, reduce errors, and enhance transparency. Moreover, they provide businesses with greater control over their cash flow, enabling them to make informed financial decisions. Historically, business payments have evolved alongside technological advancements, with the introduction of electronic payment systems and online banking revolutionizing the way businesses conduct financial transactions. In today's digital landscape, businesses have access to a wide range of payment options, each tailored to meet their specific needs and preferences.

The main topics covered in this article include:

Read also:Live Telemundo Pr Stay Informed With Local News And Entertainment

- Types of business payments

- Benefits of efficient business payment systems

- Emerging trends in business payments

- Best practices for managing business payments

- The future of business payments

Business Payment

Business payments are essential for the smooth functioning of any economy. They allow businesses to purchase goods and services from each other, and to pay their employees and suppliers. There are many different types of business payments, each with its own advantages and disadvantages.

- Types: There are many different types of business payments, including checks, wire transfers, ACH payments, and credit cards.

- Efficiency: Efficient business payment systems can save businesses time and money.

- Security: Business payments must be secure in order to protect businesses from fraud.

- Convenience: Business payments should be convenient for both the payer and the payee.

- Cost: The cost of business payments can vary depending on the type of payment and the amount being transferred.

- Integration: Business payment systems should be integrated with other business systems, such as accounting and inventory management systems.

- Compliance: Business payments must comply with all applicable laws and regulations.

These are just a few of the key aspects of business payments. By understanding these aspects, businesses can make informed decisions about how to manage their payments and improve their overall financial performance.

For example, a business that wants to improve its efficiency may choose to implement an electronic payment system. This can save time and money by automating the payment process. Another business that is concerned about security may choose to use a payment processor that offers fraud protection services. By understanding the key aspects of business payments, businesses can make informed decisions about how to manage their payments and improve their overall financial performance.

1. Types

The various types of business payments each have their own advantages and disadvantages, making it crucial for businesses to select the most appropriate method based on their specific requirements. For instance, checks are a traditional and widely accepted form of payment, but they can be time-consuming to process and may pose security risks. Wire transfers, on the other hand, are faster and more secure, but they often come with higher transaction fees. ACH payments offer a balance between cost and speed, making them a popular choice for businesses that need to make high-volume, low-value payments. Credit cards provide businesses with a convenient way to make purchases, but they can also incur significant fees and interest charges.

- Checks: Checks are a traditional form of payment that involves writing an instruction to a bank to pay a certain amount of money to a specified recipient. They are widely accepted and relatively inexpensive, but they can be slow to process and may pose security risks.

- Wire transfers: Wire transfers are electronic payments that are sent directly from one bank account to another. They are faster and more secure than checks, but they often come with higher transaction fees.

- ACH payments: ACH payments are electronic payments that are processed through the Automated Clearing House (ACH) network. They are less expensive than wire transfers and can be used to make both one-time and recurring payments.

- Credit cards: Credit cards allow businesses to make purchases without having to pay the full amount upfront. They are convenient and widely accepted, but they can also incur significant fees and interest charges.

By understanding the different types of business payments and their respective advantages and disadvantages, businesses can make informed decisions about which methods to use for their specific needs. This can help them save time and money, improve security, and increase efficiency.

2. Efficiency

Efficient business payment systems are essential for businesses of all sizes. They can save businesses time and money by automating tasks, reducing errors, and improving communication between businesses and their customers.

Read also:Ultimate Guide To Eastern Standard Provisions Your Blueprint For Success

- Automation: Business payment systems can automate many tasks, such as sending invoices, processing payments, and reconciling accounts. This can free up employees to focus on more strategic tasks, such as growing the business.

- Reduced errors: Automated business payment systems can help to reduce errors by eliminating the need for manual data entry. This can save businesses time and money by preventing costly mistakes.

- Improved communication: Business payment systems can improve communication between businesses and their customers by providing a central platform for managing payments. This can help to reduce confusion and delays, and can lead to better customer satisfaction.

In addition to these benefits, efficient business payment systems can also help businesses to improve their cash flow and make better financial decisions. By automating tasks and reducing errors, businesses can free up resources that can be used to invest in growth initiatives. Additionally, by having a clear understanding of their cash flow, businesses can make better decisions about how to allocate their resources.

3. Security

In the realm of business payments, security is of paramount importance. Breaches in payment security can lead to devastating consequences for businesses, including financial losses, reputational damage, and legal liabilities. Therefore, businesses must prioritize the implementation of robust security measures to safeguard their payment systems and protect themselves from fraud.

- Encryption: Encryption is a fundamental security measure that involves converting sensitive data into an unreadable format. By encrypting business payment data, businesses can protect it from unauthorized access, even if it is intercepted during transmission.

- Authentication: Authentication mechanisms ensure that only authorized individuals or systems can initiate and approve business payments. Multi-factor authentication, which requires users to provide multiple forms of identification, is a common and effective way to enhance authentication security.

- Fraud detection: Businesses can implement fraud detection systems to monitor payment transactions for suspicious activities. These systems use advanced algorithms to identify patterns and anomalies that may indicate fraudulent attempts, allowing businesses to take prompt action.

- Compliance: Adhering to industry standards and regulatory requirements is crucial for businesses to maintain secure business payment systems. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) demonstrates a business's commitment to protecting sensitive payment data and reduces the risk of security breaches.

By implementing these security measures, businesses can significantly reduce their vulnerability to fraud and protect their financial assets. A secure business payment system is not only essential for safeguarding the interests of the business but also for maintaining customer trust and confidence.

4. Convenience

In the dynamic world of business, convenience plays a pivotal role in ensuring smooth and efficient payment transactions. Convenient business payment systems offer numerous advantages, making them indispensable for businesses of all sizes.

- Time-Saving: Convenient business payment systems streamline the payment process, saving valuable time for both the payer and the payee. Automated features, such as pre-populated payment forms and one-click payments, eliminate the need for manual data entry and reduce the risk of errors.

- Cost-Effective: Convenience often translates to cost-effectiveness in the realm of business payments. By reducing the time and effort required to process payments, businesses can minimize administrative costs and redirect resources towards core business operations.

- Improved Customer Satisfaction: Convenient payment systems enhance customer satisfaction by providing a seamless and hassle-free payment experience. Businesses that offer multiple payment options and flexible payment schedules demonstrate a commitment to customer convenience, leading to increased loyalty and repeat business.

- Competitive Advantage: In today's competitive business landscape, convenience serves as a key differentiator. Businesses that prioritize convenience for their customers gain a competitive edge by attracting and retaining a wider customer base.

By embracing convenient business payment systems, businesses not only enhance their operational efficiency but also foster stronger relationships with their customers. Convenience is an essential ingredient in the recipe for successful and sustainable business practices.

5. Cost

The cost of business payments is a crucial consideration for businesses. Different payment types and transfer amounts can significantly impact the fees associated with the transaction. Understanding these costs allows businesses to make informed decisions and optimize their payment strategies.

- Type of Payment: The type of payment method used can influence the cost. Traditional methods like checks and wire transfers typically have lower fees for small-value payments, while digital payment systems may charge higher fees for added convenience and features.

- Transaction Amount: The amount being transferred also affects the cost. Larger transactions often incur higher fees, especially for wire transfers and international payments. Some payment providers may offer tiered pricing based on transaction volume or value.

- Currency Conversion: Businesses making payments in foreign currencies may incur additional costs for currency conversion. Exchange rates and conversion fees can vary depending on the payment provider and the currency pair involved.

- Payment Frequency: The frequency of payments can also impact the overall cost. Regular or recurring payments may qualify for discounted rates or bundled pricing from payment providers.

By considering these factors, businesses can effectively manage the costs associated with business payments. Choosing the right payment method, optimizing transaction amounts, and leveraging cost-saving options can help businesses minimize their expenses and maximize their financial efficiency.

6. Integration

Integration between business payment systems and other business systems, such as accounting and inventory management systems, is crucial for efficient and accurate financial operations. This integration creates a seamless flow of data between different systems, eliminating manual data entry and reducing the risk of errors.

For instance, when a business payment is made through an integrated payment system, the transaction details are automatically recorded in the accounting system. This eliminates the need for manual entry, saving time and reducing the likelihood of errors. Additionally, integrated inventory management systems can track inventory levels and automatically generate purchase orders when stock falls below a certain threshold. This integration ensures that businesses have the necessary inventory to fulfill customer orders without overstocking or experiencing stockouts.

The integration of business payment systems with other business systems provides several benefits, including:

- Improved accuracy: Automated data transfer eliminates manual entry errors, leading to more accurate financial records.

- Increased efficiency: Streamlined processes save time and resources, allowing businesses to focus on core activities.

- Enhanced visibility: Integrated systems provide a comprehensive view of financial data, enabling better decision-making.

- Reduced costs: Automation reduces the need for manual labor, lowering operating expenses.

In conclusion, integrating business payment systems with other business systems is essential for businesses seeking to optimize their financial operations. The benefits of integration include improved accuracy, increased efficiency, enhanced visibility, and reduced costs. By embracing integration, businesses can gain a competitive edge and position themselves for success in today's dynamic business environment.

7. Compliance

Compliance is a fundamental aspect of business payments, ensuring that businesses operate within the legal and regulatory frameworks governing financial transactions. Failure to comply with these regulations can result in severe consequences, including fines, legal liabilities, and reputational damage.

One of the key reasons for compliance in business payments is the prevention of financial crimes, such as money laundering and terrorist financing. Governments and regulatory bodies have implemented strict regulations to combat these illicit activities, requiring businesses to implement robust anti-money laundering (AML) and know-your-customer (KYC) measures. By complying with these regulations, businesses can help to safeguard the financial system and protect themselves from being used as conduits for illegal transactions.

Another important aspect of compliance is the protection of consumer rights. Regulations such as the Payment Services Directive (PSD2) in the European Union aim to enhance consumer protection in electronic payments. These regulations mandate strong customer authentication measures to prevent unauthorized transactions and provide consumers with recourse in case of fraud or errors.

In addition to legal and regulatory obligations, compliance in business payments also makes good business sense. By adhering to best practices and industry standards, businesses can build trust with their customers and partners. A reputation for compliance can attract new business and foster long-term relationships.

In summary, compliance is an essential component of business payments, ensuring that businesses operate within legal and regulatory frameworks, prevent financial crimes, protect consumer rights, and maintain a positive reputation. Understanding and adhering to compliance requirements is crucial for businesses to succeed in today's complex and regulated financial landscape.

Business Payment FAQs

This section addresses frequently asked questions (FAQs) about business payments, providing concise and informative answers to common concerns and misconceptions.

Question 1: What are the different types of business payments?

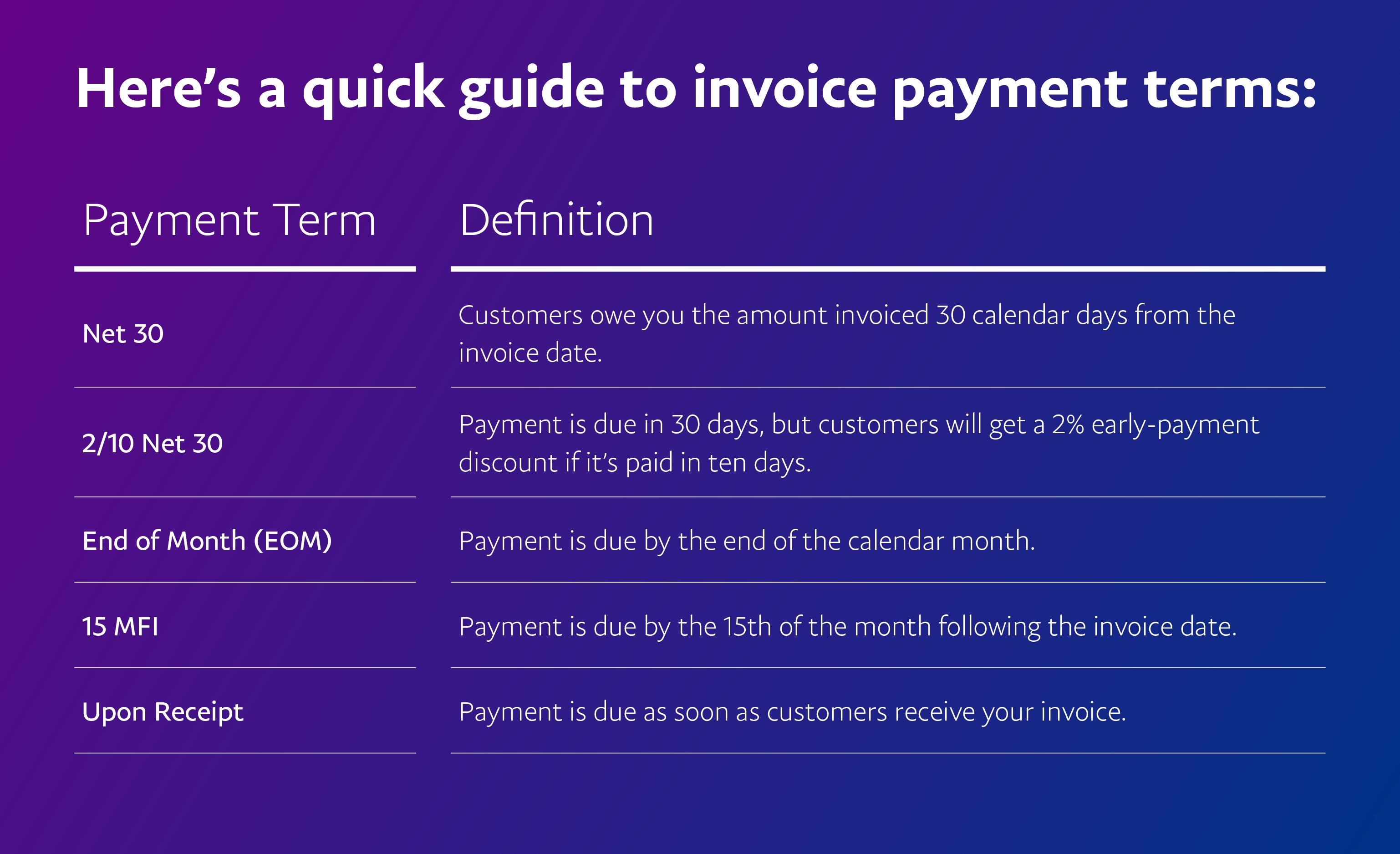

There are various types of business payments, including checks, wire transfers, ACH payments, credit cards, and mobile payments. Each type has its advantages and disadvantages, so it's important to choose the most appropriate method based on factors such as cost, speed, security, and convenience.

Question 2: What is the best way to choose a business payment method?

The best business payment method depends on the specific needs of the business. Considerations include transaction volume, transaction value, payment frequency, security requirements, and integration with accounting systems. It's often advisable to consult with a financial advisor or payment service provider to determine the most suitable option.

Question 3: How can businesses ensure the security of their business payments?

Businesses can enhance the security of their business payments by implementing strong security measures such as encryption, two-factor authentication, fraud detection systems, and compliance with industry standards like PCI DSS. Regularly monitoring payment transactions for suspicious activities and educating employees about payment security best practices are also crucial.

Question 4: What are the common challenges associated with business payments?

Some common challenges faced by businesses in managing business payments include payment delays, high transaction fees, fraud, and compliance with regulations. Businesses can overcome these challenges by choosing efficient payment methods, negotiating favorable terms with payment providers, implementing fraud prevention measures, and staying up-to-date with regulatory requirements.

Question 5: What are the emerging trends in business payments?

Emerging trends in business payments include the increasing adoption of digital payment methods, the rise of mobile payments, the integration of artificial intelligence and machine learning for fraud detection, and the growing popularity of real-time payments. These trends are shaping the future of business payments by offering greater convenience, efficiency, and security.

Question 6: How can businesses optimize their business payment processes?

Businesses can optimize their business payment processes by automating tasks, integrating payment systems with accounting and ERP systems, implementing electronic invoicing and payment systems, and leveraging technology for real-time payment tracking and reconciliation. By optimizing their payment processes, businesses can save time, reduce costs, and improve efficiency.

In conclusion, understanding the different aspects of business payments, choosing the right payment methods, ensuring security, addressing common challenges, staying informed about emerging trends, and optimizing payment processes are essential for businesses to effectively manage their financial transactions and maintain smooth business operations.

Transition to the next article section:

For further insights into business payments, including best practices, case studies, and industry analysis, please refer to the "Resources" section below.

Tips for Business Payments

Efficient and secure business payment processes are essential for the smooth functioning of any organization. Here are some tips to help businesses optimize their business payments:

Tip 1: Choose the Right Payment Methods

Selecting the appropriate payment methods can save businesses time and money. Factors to consider include transaction volume, value, frequency, security, and integration with accounting systems. Digital payment methods, such as ACH payments and wire transfers, offer convenience and efficiency, while traditional methods like checks may be more suitable for low-value transactions.

Tip 2: Prioritize Security

Protecting business payments from fraud and cyber threats is crucial. Implementing robust security measures such as encryption, two-factor authentication, and fraud detection systems can safeguard sensitive financial information. Regularly updating software and adhering to industry security standards like PCI DSS further enhance payment security.

Tip 3: Optimize Payment Processes

Automating payment tasks, integrating payment systems with accounting software, and leveraging electronic invoicing can streamline payment processes, saving time and reducing errors. Real-time payment tracking and reconciliation systems provide greater visibility and control over cash flow.

Tip 4: Manage Cash Flow Effectively

Understanding cash flow patterns and forecasting future payments can help businesses avoid cash flow shortages and optimize working capital. Implementing payment schedules, negotiating favorable payment terms with suppliers, and exploring early payment discounts can improve cash flow management.

Tip 5: Stay Informed About Regulations

Compliance with industry regulations and legal requirements is essential for business payments. Staying up-to-date with regulations, such as PCI DSS and anti-money laundering laws, ensures compliance and protects businesses from penalties and reputational damage.

Conclusion

By implementing these tips, businesses can improve the efficiency, security, and overall management of their business payments. Optimizing payment processes, prioritizing security, and staying informed about regulations can help businesses streamline operations, reduce costs, and enhance financial performance.

Conclusion

In the dynamic world of commerce, business payments serve as the lifeblood of financial transactions. This article has delved into the multifaceted nature of business payments, examining their types, benefits, and challenges. We have explored the importance of efficient, secure, and compliant payment systems for businesses of all sizes.

As we move forward, the future of business payments holds exciting possibilities. The adoption of digital technologies, the rise of mobile payments, and the integration of artificial intelligence will continue to shape the landscape. Businesses that embrace these advancements and stay abreast of regulatory changes will be well-positioned to navigate the evolving financial landscape and drive success.