The dream of homeownership is a significant milestone for many individuals and families. However, navigating the real estate market can often be daunting, especially for first-time buyers. This is where Fannie Mae Homepath comes into play, offering a pathway to homeownership through a unique program designed to assist buyers in purchasing foreclosed homes owned by Fannie Mae.

Fannie Mae Homepath provides a streamlined process for buying foreclosed properties, making it easier for potential homeowners to transition from renting to owning. This initiative not only benefits buyers but also helps stabilize neighborhoods and communities affected by foreclosures. With attractive features such as reduced down payments and the absence of private mortgage insurance requirements, Fannie Mae Homepath opens doors to affordable home buying opportunities.

In this comprehensive guide, we will delve into the intricacies of the Fannie Mae Homepath program. We will explore its benefits, eligibility criteria, and tips for navigating the home-buying process through this initiative. Whether you're a first-time homebuyer or looking for investment opportunities, understanding Fannie Mae Homepath can be a crucial step toward achieving your real estate goals.

Read also:Discover Essential News With The Jamaica Observer

Table of Contents

- What is Fannie Mae Homepath?

- History and Background of Fannie Mae

- How Does Fannie Mae Homepath Work?

- Eligibility Criteria for Homepath

- Benefits of Buying Through Homepath

- Fannie Mae Homepath Financing Options

- How to Find Homepath Properties?

- The Home Buying Process with Homepath

- Tips for First-Time Homepath Buyers

- Fannie Mae Homepath Renovation Loan

- Comparing Homepath with Other Housing Programs

- Common Misconceptions About Homepath

- Success Stories from Homepath Buyers

- Frequently Asked Questions

- Conclusion

What is Fannie Mae Homepath?

Fannie Mae Homepath is a program designed to facilitate the sale of homes owned by Fannie Mae following foreclosure. These properties, known as "Homepath properties," are available to the public, offering potential buyers an opportunity to purchase homes at competitive prices. The program aims to support neighborhood stabilization by providing affordable housing options and reducing the inventory of foreclosed properties.

Homepath properties are typically sold "as-is," meaning they may require some repairs or renovations. However, the program offers several incentives to make the purchasing process more appealing, such as lower down payments and flexible financing options. Additionally, Fannie Mae Homepath does not require private mortgage insurance (PMI), which can significantly reduce monthly mortgage payments for buyers.

History and Background of Fannie Mae

Fannie Mae, formally known as the Federal National Mortgage Association (FNMA), was established in 1938 as part of the New Deal. Its primary mission is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS). This process increases the availability of funds for lenders, enabling more individuals and families to access affordable home loans.

Over the years, Fannie Mae has played a crucial role in the housing finance system of the United States. Its efforts have contributed to the stability and liquidity of the mortgage market, particularly during times of economic uncertainty. The introduction of the Homepath program is a testament to Fannie Mae's commitment to promoting homeownership and supporting communities affected by foreclosures.

How Does Fannie Mae Homepath Work?

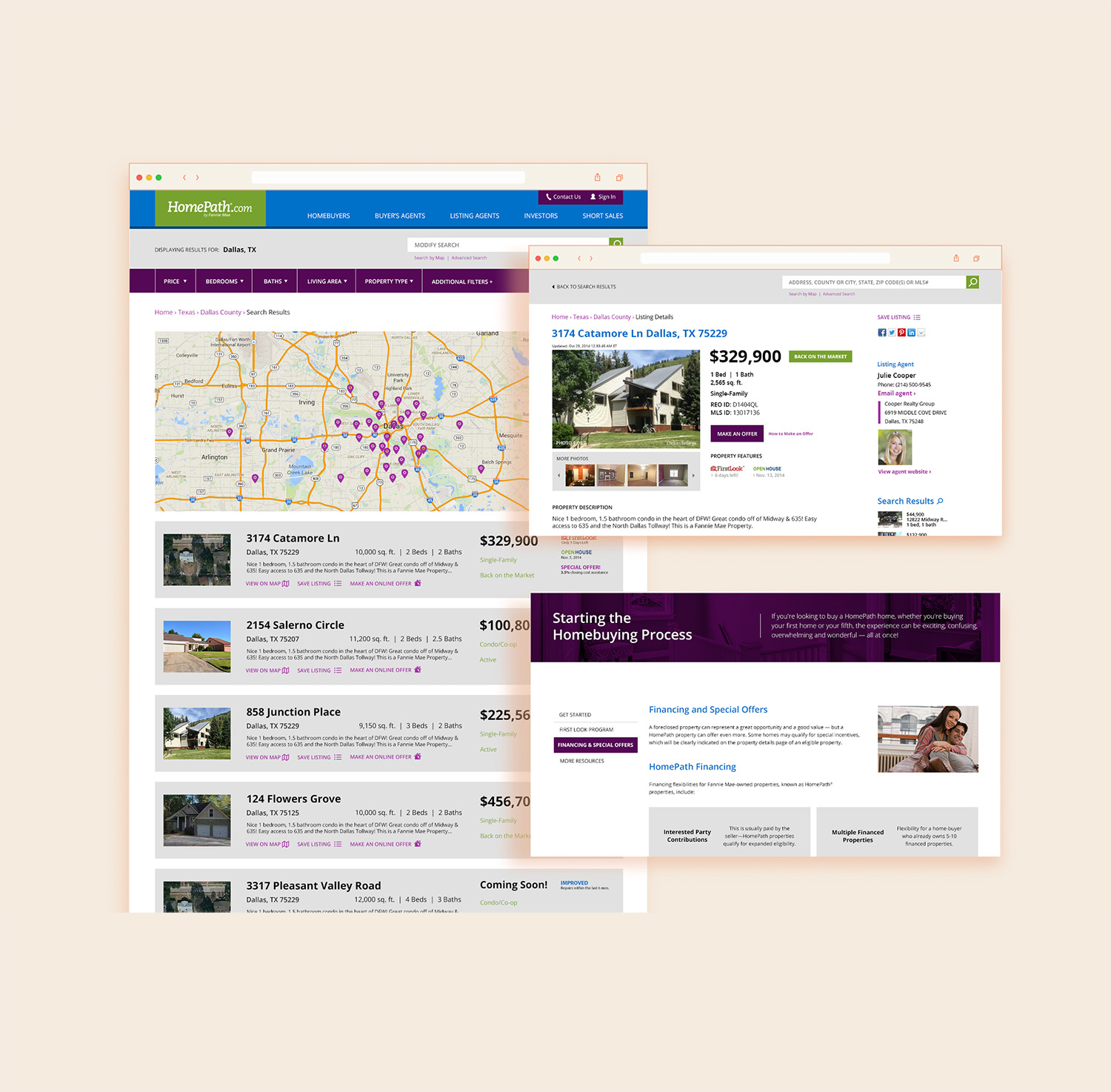

The Fannie Mae Homepath program operates by providing a platform for the sale of foreclosed properties owned by Fannie Mae. These properties are listed on the Homepath website, where potential buyers can browse available homes in their desired locations. The program is designed to streamline the buying process, making it more accessible and straightforward for interested parties.

Once a buyer identifies a suitable Homepath property, they can proceed with making an offer through a licensed real estate agent. The offer is subject to review and acceptance by Fannie Mae. If approved, the buyer can move forward with securing financing, conducting inspections, and closing the sale. The Homepath program offers various financing options, including the HomeReady Mortgage, which provides favorable terms for eligible buyers.

Read also:Is Justin Bieber Still Alive The True Story

Eligibility Criteria for Homepath

To participate in the Fannie Mae Homepath program, buyers must meet certain eligibility criteria. These requirements are designed to ensure that the program benefits those who are genuinely interested in purchasing and occupying the home. Key eligibility criteria include:

- The buyer must be an individual, not a corporation or business entity.

- The property must be intended for owner-occupancy, although some exceptions may apply for investment properties.

- The buyer must work with a licensed real estate agent to submit offers and complete the purchase process.

- Potential buyers must have the financial means to complete the purchase, including securing financing and covering closing costs.

It's important for buyers to review the specific eligibility criteria outlined by Fannie Mae and consult with their real estate agent to ensure compliance with program requirements.

Benefits of Buying Through Homepath

The Fannie Mae Homepath program offers several benefits for individuals and families looking to purchase a home. Some of the key advantages include:

- Affordability: Homepath properties are often priced competitively, providing buyers with access to affordable housing options.

- No PMI Requirements: Unlike traditional loans, Homepath mortgages do not require private mortgage insurance, reducing monthly costs for buyers.

- Flexible Financing Options: The program offers various financing options, including the HomeReady Mortgage, which provides favorable terms for eligible buyers.

- Potential for Renovation: Buyers have the opportunity to invest in property improvements and increase the home's value through the Homepath Renovation Loan.

- Neighborhood Stabilization: Purchasing a Homepath property contributes to community revitalization and reduces the impact of foreclosures on neighborhoods.

These benefits make the Fannie Mae Homepath program an attractive option for prospective homeowners seeking a cost-effective and straightforward path to homeownership.

Fannie Mae Homepath Financing Options

Financing a home purchase through the Fannie Mae Homepath program can be achieved through various loan options. One of the most popular choices is the HomeReady Mortgage, which offers several advantages for eligible buyers. Key features of the HomeReady Mortgage include:

- Low Down Payment: Buyers can enjoy a reduced down payment requirement, making it easier to enter the housing market.

- Flexible Credit Requirements: The program accommodates a range of credit scores, providing access to financing for more buyers.

- Competitive Interest Rates: Eligible buyers can benefit from favorable interest rates, reducing the long-term cost of the loan.

- Borrower Education: Buyers are encouraged to complete a homeownership education course, equipping them with valuable knowledge and skills for successful homeownership.

In addition to the HomeReady Mortgage, buyers may also explore other financing options available through local lenders. It's essential to compare loan terms and work with a qualified mortgage professional to determine the best fit for individual needs and circumstances.

How to Find Homepath Properties?

Locating Fannie Mae Homepath properties is a straightforward process, thanks to the comprehensive resources available online. Interested buyers can follow these steps to find suitable homes:

- Visit the Homepath Website: The official Homepath website (homepath.com) is the primary platform for browsing available properties. Buyers can use the search feature to filter listings by location, price range, and property type.

- Work with a Real Estate Agent: Collaborating with a licensed real estate agent familiar with the Homepath program can provide valuable insights and assistance throughout the home-buying process.

- Attend Open Houses: Attending open houses and property showings can help buyers assess the condition and suitability of potential homes.

- Monitor New Listings: Regularly checking the Homepath website and subscribing to alerts can keep buyers informed about new listings and opportunities.

By following these steps, buyers can effectively navigate the market and identify Homepath properties that align with their preferences and budget.

The Home Buying Process with Homepath

Purchasing a home through the Fannie Mae Homepath program involves several key steps. Understanding the process can help buyers prepare and streamline their journey to homeownership:

- Determine Eligibility: Review the program's eligibility criteria to ensure compliance and assess financial readiness for homeownership.

- Find a Suitable Property: Use the Homepath website and work with a real estate agent to identify potential homes that meet desired criteria.

- Make an Offer: Submit an offer through a licensed real estate agent. The offer should be competitive and align with the property's market value.

- Secure Financing: Once the offer is accepted, buyers must secure financing through an appropriate loan program, such as the HomeReady Mortgage.

- Conduct Inspections: Arrange for home inspections to assess the property's condition and identify any necessary repairs or improvements.

- Close the Sale: Complete the closing process, including signing necessary documents and transferring ownership of the property.

By following these steps and working closely with professionals, buyers can navigate the home-buying process with confidence and achieve successful homeownership.

Tips for First-Time Homepath Buyers

First-time buyers considering the Fannie Mae Homepath program can benefit from the following tips to enhance their home-buying experience:

- Set a Realistic Budget: Determine a budget that accounts for the purchase price, closing costs, and potential renovation expenses.

- Conduct Thorough Research: Research the local real estate market, property values, and neighborhood amenities to make informed decisions.

- Get Pre-Approved for Financing: Obtain pre-approval for a mortgage to demonstrate financial readiness and strengthen offers.

- Prioritize Property Inspections: Schedule comprehensive inspections to identify any structural or mechanical issues with the property.

- Stay Open to Renovations: Consider properties that may require minor renovations or updates, as these can offer value and customization opportunities.

By following these tips, first-time buyers can navigate the Homepath program with confidence and make informed decisions that align with their homeownership goals.

Fannie Mae Homepath Renovation Loan

The Fannie Mae Homepath Renovation Loan is an option for buyers interested in purchasing a Homepath property that requires repairs or upgrades. This loan allows buyers to finance both the purchase price and the cost of renovations in a single mortgage, simplifying the process and making it more affordable.

Key features of the Homepath Renovation Loan include:

- Single Loan Structure: Combine the purchase and renovation costs into a single loan, reducing the need for separate financing.

- Flexible Renovation Options: Finance a wide range of improvements, from minor repairs to major renovations, enhancing the property's value and livability.

- Competitive Interest Rates: Enjoy competitive interest rates that align with conventional mortgage terms.

The Homepath Renovation Loan is an excellent choice for buyers looking to customize their new home and invest in property improvements. By leveraging this financing option, buyers can transform a fixer-upper into their dream home.

Comparing Homepath with Other Housing Programs

When considering home-buying programs, it's essential to compare the Fannie Mae Homepath program with other available options. Some popular alternatives include:

FHA Loans

Federal Housing Administration (FHA) loans are a popular choice for first-time buyers due to their low down payment requirements and flexible credit criteria. Unlike Homepath, FHA loans require private mortgage insurance, which can increase monthly payments.

VA Loans

Veterans Affairs (VA) loans are available to eligible veterans and active-duty service members, offering benefits such as no down payment and no PMI requirements. However, these loans are limited to qualifying individuals and may not be available for all buyers.

While each program offers unique advantages, the Fannie Mae Homepath program stands out for its focus on foreclosed properties and neighborhood stabilization. Buyers should carefully evaluate their options and consult with professionals to determine the best fit for their needs.

Common Misconceptions About Homepath

Several misconceptions surround the Fannie Mae Homepath program, which may deter potential buyers. It's important to address these misunderstandings and provide accurate information:

- Misconception: Homepath Properties Are Always in Poor Condition. While some properties may require repairs, many Homepath homes are in good condition and present excellent value.

- Misconception: Only First-Time Buyers Can Use Homepath. The program is open to all eligible buyers, not just first-time homeowners.

- Misconception: Financing Is Complicated and Limited. Homepath offers flexible financing options, including the HomeReady Mortgage, with competitive terms.

- Misconception: Homepath Is Only for Investors. While investors can purchase Homepath properties, the program primarily targets owner-occupants to support neighborhood stabilization.

By dispelling these misconceptions, more buyers can explore the opportunities offered by the Fannie Mae Homepath program and consider it a viable option for homeownership.

Success Stories from Homepath Buyers

Many buyers have successfully navigated the Fannie Mae Homepath program and achieved their goal of homeownership. Here are a few inspiring success stories:

Family Finds Dream Home

The Johnson family was searching for an affordable home in a desirable neighborhood. Through the Homepath program, they discovered a property that met their needs and budget. With the help of a real estate agent and the HomeReady Mortgage, they closed the deal and moved into their dream home.

Investor Renovates and Resells

Investor Michael saw potential in a Homepath property needing renovation. By utilizing the Homepath Renovation Loan, he transformed the property and resold it for a substantial profit. The project contributed to neighborhood revitalization and provided a quality home for a new family.

These stories illustrate the diverse opportunities available through the Homepath program and the positive impact it can have on buyers and communities.

Frequently Asked Questions

What types of properties are available through Homepath?

Homepath properties include single-family homes, condos, and townhouses that have been foreclosed and are owned by Fannie Mae. These properties are located nationwide and vary in size, style, and condition.

Can investors purchase Homepath properties?

Yes, investors can purchase Homepath properties. However, preference may be given to owner-occupants during the initial listing period to support neighborhood stabilization efforts.

Is it possible to negotiate the price of a Homepath property?

While Fannie Mae sets the list price based on market conditions and property value, buyers can submit competitive offers through their real estate agent. Negotiations may occur depending on demand and other factors.

Do Homepath properties come with warranties?

Homepath properties are typically sold "as-is," meaning they do not include warranties. Buyers are encouraged to conduct thorough inspections to assess the condition of the home before purchase.

How do I get started with the Homepath program?

To get started, visit the Homepath website to browse available properties and work with a licensed real estate agent familiar with the program. Pre-approval for financing can also strengthen your position as a buyer.

Are there any additional incentives for first-time buyers?

First-time buyers may benefit from incentives such as low down payments and no PMI requirements. Additionally, completing a homeownership education course can provide valuable knowledge and skills.

Conclusion

Fannie Mae Homepath represents a valuable opportunity for individuals and families seeking affordable homeownership. By providing access to foreclosed properties at competitive prices, the program supports both buyers and communities in achieving stability and growth. With flexible financing options and incentives, Homepath makes the dream of homeownership more attainable than ever. By understanding the program's features and benefits, buyers can confidently navigate the path to owning a home and contribute to revitalizing neighborhoods across the nation.

For additional information and resources, consider exploring external links such as the official Fannie Mae website, which offers further insights into their programs and initiatives.