A property appraiser is a public official responsible for determining the value of real property for the purpose of taxation. The Collier County Property Appraiser's Office is responsible for appraising all real property in Collier County, Florida.

The Property Appraiser's Office uses a variety of methods to determine the value of property, including comparable sales, income, and cost approaches. The office also considers factors such as location, size, and condition when determining property values.

The Property Appraiser's Office is an important part of the local government. The office's work helps to ensure that property taxes are fair and equitable. The office also provides valuable data to homeowners, businesses, and other stakeholders.

Read also:Experience Thrill At Marcus Southbridge Crossing Cinema

collier county property appraiser

The Collier County Property Appraiser is responsible for determining the value of all real property in Collier County, Florida, for the purpose of taxation. The office uses a variety of methods to determine the value of property, including comparable sales, income, and cost approaches. The office also considers factors such as location, size, and condition when determining property values.

- Responsible

- Valuation

- Taxation

- Real property

- Collier County

- Florida

The Property Appraiser's Office is an important part of the local government. The office's work helps to ensure that property taxes are fair and equitable. The office also provides valuable data to homeowners, businesses, and other stakeholders.

1. Responsible

The Collier County Property Appraiser is responsible for a variety of tasks, including:

- Determining the value of all real property in Collier County - This is the Property Appraiser's most important responsibility. The office uses a variety of methods to determine the value of property, including comparable sales, income, and cost approaches. The office also considers factors such as location, size, and condition when determining property values.

- Maintaining accurate property records - The Property Appraiser's Office maintains a database of all real property in Collier County. This database includes information such as the property's location, size, value, and ownership history.

- Processing property tax exemptions - The Property Appraiser's Office processes property tax exemptions for eligible property owners. These exemptions can save homeowners a significant amount of money on their property taxes.

- Providing customer service - The Property Appraiser's Office provides customer service to property owners and other stakeholders. The office staff can answer questions about property values, property taxes, and other related topics.

The Property Appraiser's Office is an important part of the local government. The office's work helps to ensure that property taxes are fair and equitable. The office also provides valuable data to homeowners, businesses, and other stakeholders.

2. Valuation

Valuation is a key component of the Collier County Property Appraiser's work. The office is responsible for determining the value of all real property in Collier County for the purpose of taxation. Accurate valuations are essential for ensuring that property taxes are fair and equitable.

The Property Appraiser's Office uses a variety of methods to determine the value of property, including comparable sales, income, and cost approaches. The office also considers factors such as location, size, and condition when determining property values.

Read also:The Ultimate Marketplace Find Everything You Need Huntsville Al

The Property Appraiser's Office's valuations are used to calculate property taxes. Property taxes are a major source of revenue for local governments. They are used to fund essential services such as schools, roads, and libraries.

It is important for property owners to understand how their property is valued. This information can help them to make informed decisions about their property taxes. Property owners can also appeal their property values if they believe that they are inaccurate.

3. Taxation

Taxation is a critical component of the Collier County Property Appraiser's work. The office is responsible for determining the value of all real property in Collier County for the purpose of taxation. Accurate valuations are essential for ensuring that property taxes are fair and equitable.

Property taxes are a major source of revenue for local governments. They are used to fund essential services such as schools, roads, and libraries. The Collier County Property Appraiser's Office plays a vital role in ensuring that these services are adequately funded by providing accurate property valuations.

Property owners should understand how their property is valued and how those valuations are used to calculate their property taxes. This information can help them to make informed decisions about their property taxes and to ensure that they are paying their fair share.

4. Real property

Real property, also known as real estate, is land and anything permanently attached to it, including buildings, structures, fixtures, and improvements. Real property is a major component of the Collier County Property Appraiser's work. The office is responsible for determining the value of all real property in Collier County for the purpose of taxation.

The value of real property is determined by a number of factors, including its location, size, condition, and use. The Property Appraiser's Office uses a variety of methods to determine the value of real property, including comparable sales, income, and cost approaches.

Accurate valuations of real property are essential for ensuring that property taxes are fair and equitable. Property taxes are a major source of revenue for local governments. They are used to fund essential services such as schools, roads, and libraries.

Property owners should understand how their real property is valued and how those valuations are used to calculate their property taxes. This information can help them to make informed decisions about their property taxes and to ensure that they are paying their fair share.

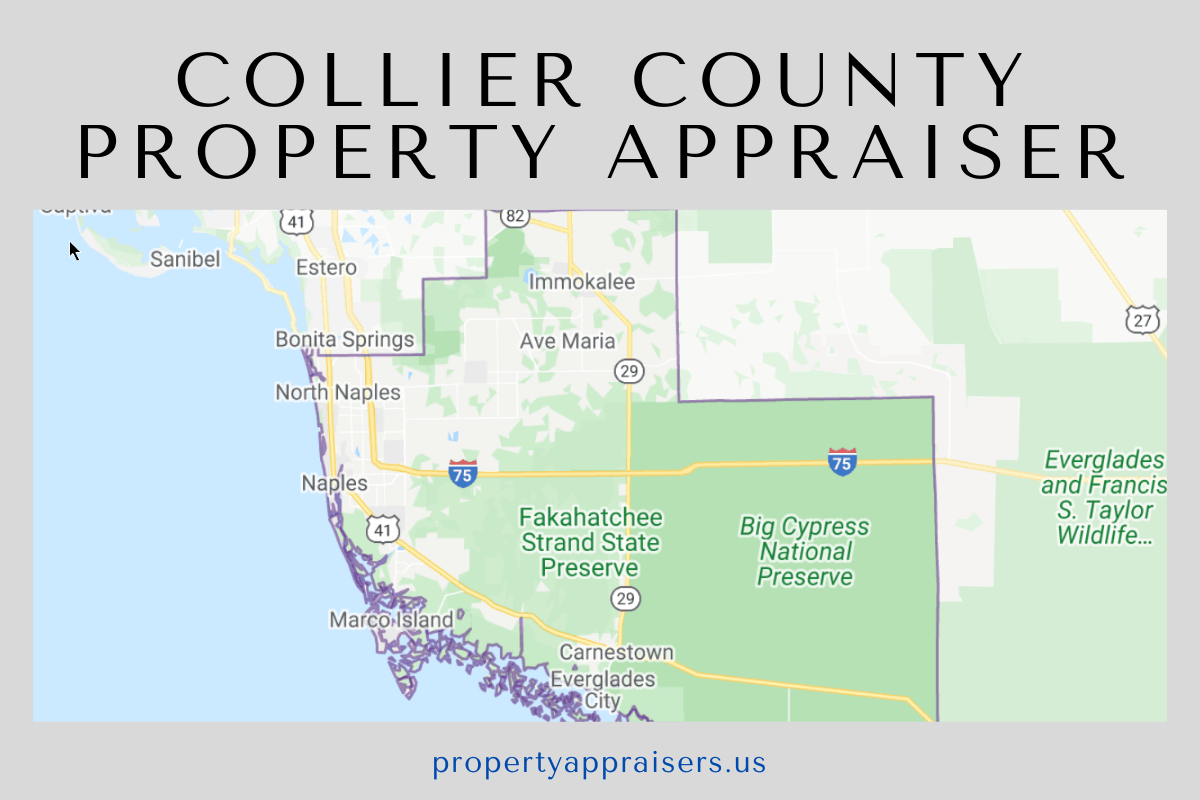

5. Collier County

Collier County is a county located in the southwestern region of the U.S. state of Florida. It is named after Barron Collier, a prominent land developer who played a key role in the county's early development. Collier County is known for its beautiful beaches, lush landscapes, and vibrant arts and culture scene. It is also home to a number of world-renowned golf courses and luxury resorts.

The Collier County Property Appraiser is the elected official responsible for determining the value of all real property in Collier County for the purpose of taxation. The Property Appraiser's Office is an important part of the local government, as its work helps to ensure that property taxes are fair and equitable. The Property Appraiser's Office also provides valuable data to homeowners, businesses, and other stakeholders.

The connection between Collier County and the Collier County Property Appraiser is clear. The Property Appraiser's Office is responsible for valuing all real property in the county, which is essential for ensuring that property taxes are fair and equitable. The Property Appraiser's Office also provides valuable data to homeowners, businesses, and other stakeholders, which can be used to make informed decisions about property ownership and investment.

6. Florida

The Collier County Property Appraiser is responsible for determining the value of all real property in Collier County, Florida, for the purpose of taxation. The Property Appraiser's Office is an important part of the local government, as its work helps to ensure that property taxes are fair and equitable. The Property Appraiser's Office also provides valuable data to homeowners, businesses, and other stakeholders.

Florida is a significant component of the Collier County Property Appraiser's work because the state's laws and regulations govern the property appraisal process. For example, Florida law requires that all real property be appraised at its just value, which is defined as the price that a willing buyer would pay for the property in an arm's-length transaction. The Property Appraiser's Office must also follow Florida's property tax laws, which set the rates at which property taxes are assessed.

The connection between Florida and the Collier County Property Appraiser is clear. The Property Appraiser's Office is responsible for valuing all real property in the county, which is essential for ensuring that property taxes are fair and equitable. The Property Appraiser's Office also provides valuable data to homeowners, businesses, and other stakeholders, which can be used to make informed decisions about property ownership and investment.

Collier County Property Appraiser FAQs

This section provides answers to frequently asked questions about the Collier County Property Appraiser's Office.

Question 1: What is the Collier County Property Appraiser's Office responsible for?

The Collier County Property Appraiser's Office is responsible for determining the value of all real property in Collier County, Florida, for the purpose of taxation. The office also maintains accurate property records, processes property tax exemptions, and provides customer service to property owners and other stakeholders.

Question 2: How does the Property Appraiser's Office determine the value of property?

The Property Appraiser's Office uses a variety of methods to determine the value of property, including comparable sales, income, and cost approaches. The office also considers factors such as location, size, and condition when determining property values.

Question 3: What is the difference between market value and assessed value?

Market value is the price that a willing buyer would pay for a property in an arm's-length transaction. Assessed value is the value that the Property Appraiser's Office assigns to a property for the purpose of taxation. Assessed value is typically lower than market value.

Question 4: How can I appeal my property value?

Property owners can appeal their property values by filing a petition with the Value Adjustment Board. The petition must be filed within 25 days of the notice of proposed property value. For more information on the appeals process, please visit the Collier County Property Appraiser's website.

Question 5: What are property tax exemptions?

Property tax exemptions are reductions in the amount of property taxes that a property owner is required to pay. There are a variety of property tax exemptions available, including homestead exemptions, senior citizen exemptions, and disabled veteran exemptions. For more information on property tax exemptions, please visit the Collier County Property Appraiser's website.

Question 6: How can I get a copy of my property tax bill?

Property owners can obtain a copy of their property tax bill by visiting the Collier County Property Appraiser's website or by calling the office at 239-252-8400.

We hope this information has been helpful. If you have any further questions, please do not hesitate to contact the Collier County Property Appraiser's Office.

For more information, please visit the Collier County Property Appraiser's website at collierpa.org.

Tips from the Collier County Property Appraiser

The Collier County Property Appraiser's Office is responsible for determining the value of all real property in Collier County, Florida, for the purpose of taxation. The office also maintains accurate property records, processes property tax exemptions, and provides customer service to property owners and other stakeholders.

The Property Appraiser's Office offers the following tips to help property owners understand the property appraisal process and ensure that their property is valued fairly and accurately:Tip 1: Understand the property appraisal process.

The property appraisal process begins with the Property Appraiser's Office collecting data on all real property in Collier County. This data includes information such as the property's location, size, age, condition, and use. The office also considers factors such as recent sales of similar properties and current market trends when determining property values.

Tip 2: Review your property appraisal notice carefully.

Once the Property Appraiser's Office has determined the value of your property, you will receive a property appraisal notice in the mail. This notice will include information about your property's value, as well as the factors that were considered in determining that value. It is important to review your property appraisal notice carefully and to contact the Property Appraiser's Office if you have any questions or concerns.

Tip 3: File an appeal if you believe your property is overvalued.

If you believe that your property is overvalued, you can file an appeal with the Value Adjustment Board. The Value Adjustment Board is an independent body that hears appeals of property values. To file an appeal, you must submit a petition to the Value Adjustment Board within 25 days of the date of your property appraisal notice.

Tip 4: Apply for property tax exemptions if you qualify.

There are a number of property tax exemptions available to Collier County property owners, including homestead exemptions, senior citizen exemptions, and disabled veteran exemptions. To apply for a property tax exemption, you must submit an application to the Property Appraiser's Office.

Tip 5: Keep your property records up to date.

It is important to keep your property records up to date, as this information can be used to support your property appraisal. If you make any changes to your property, such as adding a new addition or renovating your home, you should notify the Property Appraiser's Office so that your property records can be updated.

By following these tips, you can help to ensure that your property is valued fairly and accurately and that you are paying your fair share of property taxes.

For more information about the property appraisal process, please visit the Collier County Property Appraiser's website at collierpa.org.

Conclusion

The Collier County Property Appraiser's Office plays a vital role in the local government. The office's work helps to ensure that property taxes are fair and equitable. The office also provides valuable data to homeowners, businesses, and other stakeholders.

Property owners should understand the property appraisal process and how their property is valued. This information can help them to make informed decisions about their property taxes and to ensure that they are paying their fair share.