Imagine a world where every dollar you spend rewards you with more savings. That's the power of cash back on Costco Visa. This card is not just a payment tool, but a gateway to a smarter spending experience where every purchase you make brings you closer to bigger savings. With the Costco Anywhere Visa® Card by Citi, you are set on a path to optimize your spending and enjoy the fruits of your financial responsibility.

In the world of rewards credit cards, the Costco Visa stands out as a leader, offering unparalleled cash back opportunities on purchases you make every day. Whether you're filling up your gas tank, dining out, or shopping for groceries, this card ensures that you get the most out of every dollar spent. It's not just about earning rewards; it's about enhancing your lifestyle with thoughtful financial choices.

The magic of the Costco Visa lies in its ability to offer cardholders a seamless blend of value and convenience. As a Costco member, you can enjoy exclusive benefits that align perfectly with your spending habits. From generous cash back rates on various categories to added security features, this card is designed to complement your financial goals and help you achieve the savings you deserve.

Read also:Discover Dogwood Social House Your Neighborhood Gathering Spot

Table of Contents

- What is the Costco Visa Card?

- How Does Cash Back Work on Costco Visa?

- Benefits of Using the Costco Visa Card

- Who is Eligible for Costco Visa?

- Comparing Cash Back Rates

- How to Maximize Cash Back Rewards?

- Understanding Costco Membership

- Savings Tips with Costco Visa

- Security Features of Costco Visa

- Frequently Asked Questions

- Conclusion

What is the Costco Visa Card?

The Costco Anywhere Visa® Card by Citi is a credit card that offers Costco members the opportunity to earn cash back on everyday purchases. This card is exclusively available to Costco members and provides a robust rewards structure that encourages smart spending. With no annual fee and impressive cash back rates, it is a valuable addition to any wallet.

Costco Visa cardholders can earn cash back on a variety of purchase categories, making it an attractive option for those who frequently shop at Costco or spend on travel, dining, and gas.

Here are some key features of the Costco Visa Card:

- No annual fee with a paid Costco membership.

- 4% cash back on eligible gas purchases worldwide, including gas at Costco, for the first $7,000 per year and then 1% thereafter.

- 3% cash back on restaurants and eligible travel purchases worldwide.

- 2% cash back on all other purchases from Costco and Costco.com.

- 1% cash back on all other purchases.

How Does Cash Back Work on Costco Visa?

Earning cash back with the Costco Visa is straightforward and designed to enhance your purchasing power. The cash back rewards are accumulated throughout the year and are issued in the form of an annual reward certificate after your February billing statement closes. This certificate can be redeemed for cash or merchandise at U.S. Costco Warehouses.

It's essential to understand the categories where you can maximize your cash back earnings:

- Gas Purchases: Earn 4% cash back on eligible gas purchases, making every trip to the pump more rewarding.

- Dining and Travel: Whether you're dining out or booking a trip, earn 3% cash back to make your experiences even more enjoyable.

- Costco Purchases: Enjoy 2% cash back on all your Costco and Costco.com purchases, adding value to every dollar spent.

- Other Purchases: For all other spending, earn 1% cash back, ensuring that even your miscellaneous expenses contribute to your savings.

Benefits of Using the Costco Visa Card

Using the Costco Visa Card offers a host of benefits beyond just cash back rewards. Here are some of the key advantages:

Read also:Varathane Stain The Ultimate Guide To Refinishing Your Dining Table

Enhanced Security Features

The Costco Visa Card comes with advanced security features to protect your financial information. From zero liability on unauthorized charges to Citi® Identity Theft Solutions, your peace of mind is a top priority.

Global Acceptance

As a Visa card, it is accepted worldwide, making it a convenient choice for international travelers. Whether you're shopping in-store or online, you can rely on your Costco Visa for seamless transactions.

Exclusive Costco Benefits

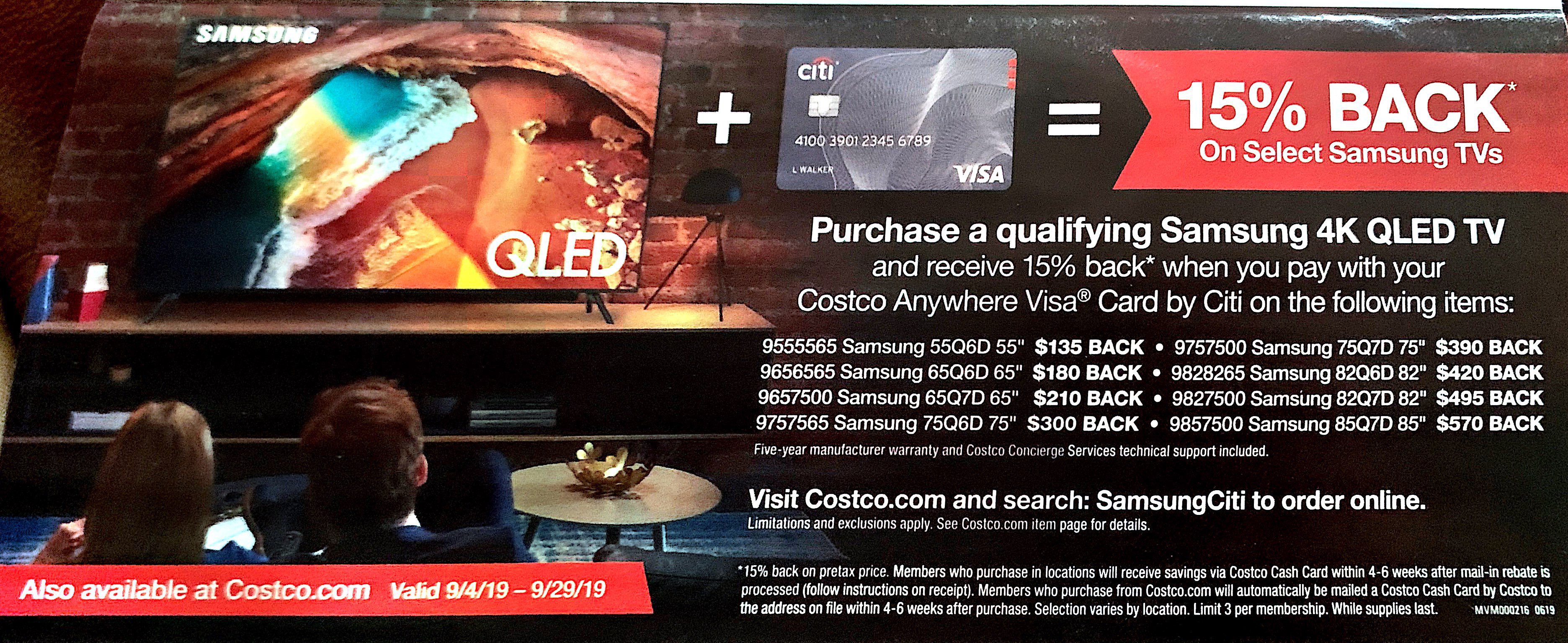

Cardholders enjoy exclusive promotions and discounts at Costco, further enhancing the value of their membership. These offers can vary, providing you with savings opportunities that align with your shopping habits.

Who is Eligible for Costco Visa?

Eligibility for the Costco Visa Card is primarily based on Costco membership. Here are the criteria you need to meet to apply for the card:

- Costco Membership: You must be a current Costco member to apply for the card. Both Gold Star and Executive Members are eligible.

- Credit Score: While Citi does not disclose a specific credit score requirement, a good to excellent credit score is recommended for approval.

- U.S. Residency: The card is available to residents of the United States who have a valid Social Security Number or Individual Taxpayer Identification Number.

If you're not a Costco member yet, consider joining to take advantage of the Costco Visa Card's benefits. Membership offers access to a wide range of products and services at competitive prices, making it a worthwhile investment.

Comparing Cash Back Rates

When it comes to cash back credit cards, the Costco Visa stands out for its competitive rewards structure. Let's compare its cash back rates with other popular credit cards:

Costco Visa vs. Competitors

While many credit cards offer 1% to 2% cash back on purchases, the Costco Visa provides higher rates in specific categories, such as gas and dining. This makes it an attractive option for those who spend frequently in these areas.

Understanding the Competition

Some cards offer rotating categories with higher cash back rates, but they often come with a quarterly limit or require activation. The Costco Visa's straightforward rewards structure makes it easier to plan and maximize your savings without any hassle.

How to Maximize Cash Back Rewards?

Maximizing your cash back rewards with the Costco Visa requires strategic planning and smart spending habits. Here are some tips to help you get the most out of your card:

Prioritize High Reward Categories

Focus your spending on categories that offer the highest cash back rates. For example, use your card for gas, dining, and travel expenses to earn the most rewards.

Utilize Costco Promotions

Take advantage of exclusive promotions and discounts available to Costco Visa cardholders. These offers can provide additional savings and increase your overall rewards.

Pace Your Spending

Be mindful of the $7,000 annual cap on gas purchases to ensure you continue earning 4% cash back. Plan your spending to maximize rewards without exceeding limits.

Understanding Costco Membership

Costco membership is a prerequisite for obtaining the Costco Visa Card, but it also brings a multitude of benefits. Here's what you need to know about being a Costco member:

Types of Membership

Costco offers two primary membership levels:

- Gold Star Membership: Ideal for individuals and households, offering access to all Costco locations and services.

- Executive Membership: Includes additional benefits, such as an annual 2% reward on eligible Costco purchases and access to exclusive member services.

Membership Renewal

Costco memberships are valid for one year and require annual renewal. Members receive a renewal notice and can renew in-store, online, or via mail.

Savings Tips with Costco Visa

Maximizing savings with the Costco Visa involves leveraging your card's features and Costco's offerings effectively. Here are some tips to help you save more:

Plan Your Shopping Trips

Create a shopping list and stick to it to avoid impulse purchases. Take advantage of Costco's bulk pricing to save on essential items.

Use Coupons and Promotions

Look for coupons and promotions in Costco's member-only savings booklets. Combine these with your card's cash back rewards for maximum savings.

Shop Online

Utilize Costco's online store for additional savings and convenience. Many items are available exclusively online, and your Costco Visa rewards apply to these purchases as well.

Security Features of Costco Visa

The Costco Visa Card offers robust security features to protect your financial information and provide peace of mind:

Zero Liability Protection

Cardholders are not held responsible for unauthorized charges made with their card, ensuring that you are protected against fraud.

Citi® Identity Theft Solutions

If you suspect identity theft, Citi provides assistance to restore your identity and resolve any issues that arise from unauthorized use.

Frequently Asked Questions

- Can I apply for the Costco Visa Card without a Costco membership?

No, a current Costco membership is required to apply for the Costco Visa Card. - How do I redeem my cash back rewards?

Cash back rewards are issued as an annual reward certificate and can be redeemed at U.S. Costco Warehouses for cash or merchandise. - Are there any foreign transaction fees with the Costco Visa?

No, the Costco Visa does not charge foreign transaction fees, making it an excellent choice for international travel. - What is the interest rate on the Costco Visa Card?

The interest rate varies based on your creditworthiness and the Prime Rate. It's important to review the terms and conditions for the most current rates. - Can I use the Costco Visa Card for non-Costco purchases?

Yes, the Costco Visa can be used for purchases anywhere Visa is accepted, not just at Costco locations. - What happens if I cancel my Costco membership?

If you cancel your membership, your Costco Visa Card will also be canceled, as it requires an active membership to remain valid.

Conclusion

The cash back on Costco Visa offers an exceptional opportunity for savvy shoppers to maximize their savings effortlessly. With its competitive rewards structure and exclusive Costco benefits, this card is a valuable tool for those who prioritize financial efficiency. By understanding how to utilize its features and aligning them with your spending habits, you can unlock a world of savings and make every purchase count.

Whether you're a frequent Costco shopper or simply looking for a reliable rewards card, the Costco Visa is designed to enhance your financial journey. Embrace the benefits and enjoy the rewards as you navigate the world of smart spending.