When it comes to planning for retirement, understanding the nuances of your pension system is crucial. Ipers Payout, a term that refers to the benefits distributed from the Iowa Public Employees' Retirement System (IPERS), plays a significant role in ensuring financial security for many Iowa residents. With numerous options and variables to consider, navigating through the details of Ipers Payout can seem daunting. However, with the right information and guidance, you can make informed decisions to maximize your retirement benefits.

IPERS serves as a lifeline for thousands of public employees in Iowa, providing them with a stable source of income during their retirement years. As a defined benefit plan, IPERS guarantees a specific payout upon retirement, which is determined by factors such as years of service and salary history. Understanding how these elements influence your Ipers Payout can empower you to plan effectively for the future and make the most of the benefits available to you.

Whether you're a public employee approaching retirement or someone just starting their career, gaining a comprehensive understanding of the Ipers Payout system is essential. This article aims to break down the complexities of these retirement benefits, offering insights into how they work, how to calculate your potential payout, and strategies to optimize your retirement income. With a focus on clarity and accessibility, we will explore everything you need to know about Ipers Payout to ensure a secure and comfortable retirement.

Read also:Discover Obituaries From John P Franklin Funeral Home

Table of Contents

- What is IPERS and Ipers Payout?

- How Does IPERS Work?

- Calculating Your Ipers Payout

- Factors Affecting Ipers Payout

- How Can You Maximize Your Retirement Benefits?

- What Are the Benefits of IPERS?

- Common Mistakes to Avoid with Ipers Payout

- Comparing IPERS with Other Retirement Plans

- How to Apply for IPERS Benefits?

- Understanding Ipers Payout Taxes

- Managing Your Ipers Payout After Retirement

- Frequently Asked Questions

- Conclusion

What is IPERS and Ipers Payout?

The Iowa Public Employees' Retirement System (IPERS) is a pension plan specifically designed for public employees in the state of Iowa. Established in 1953, IPERS provides retirement, disability, and death benefits to public workers, including teachers, police officers, and government employees. As a defined benefit plan, IPERS offers a predetermined monthly payment upon retirement, known as the Ipers Payout.

The Ipers Payout is calculated based on a formula that takes into account the employee's years of service, average salary, and a benefit multiplier. This formula ensures that employees receive a reliable and steady income throughout their retirement years. The Ipers Payout is a vital component of retirement planning for many Iowans, offering financial stability and peace of mind.

How Does IPERS Work?

IPERS operates as a defined benefit pension plan, meaning that retirees receive a guaranteed monthly payment based on a specific formula. This formula considers the employee's years of service, average salary during the highest earning years, and a predetermined benefit multiplier. Contributions to IPERS are made by both employees and employers, ensuring a robust fund to support retirees.

Employees typically contribute a percentage of their salary to the IPERS fund, with employers matching or exceeding this contribution. These contributions are invested to grow the fund, ensuring its sustainability for future retirees. Upon reaching retirement age, employees can begin receiving their Ipers Payout, providing them with a steady income stream for the rest of their lives.

Calculating Your Ipers Payout

Calculating your Ipers Payout involves understanding the key components of the formula used by IPERS. The primary factors include your years of service, final average salary, and the benefit multiplier. Here's a breakdown of how each element affects your payout:

- Years of Service: The longer you work for an IPERS-covered employer, the higher your payout will be. Each year of service adds to your benefit.

- Final Average Salary: IPERS calculates this by averaging your highest five years of salary. A higher average salary results in a higher payout.

- Benefit Multiplier: This percentage reflects the value of each year of service. It's set by IPERS and adjusts based on your employment category.

To estimate your Ipers Payout, use the formula: Payout = Years of Service x Final Average Salary x Benefit Multiplier. This calculation provides a rough estimate of your monthly retirement benefit. For a more precise figure, consider consulting with an IPERS representative or using their online calculator.

Read also:Discover Harry Myers Park Rockwall The Perfect Outdoor Getaway

Factors Affecting Ipers Payout

Several factors can influence the amount of your Ipers Payout. Understanding these variables can help you plan and maximize your retirement benefits:

- Employment Category: Different categories (e.g., regular, special service) have varying benefit multipliers, affecting the payout.

- Retirement Age: The age at which you start receiving benefits can impact the payout amount. Early retirement may reduce the payout, while delaying benefits can increase it.

- Service Credit: Additional service credits, such as military service or unused sick leave, can boost your payout.

- Cost-of-Living Adjustments (COLAs): Periodic adjustments to account for inflation can increase your payout over time.

By understanding these factors and how they interact, you can make informed decisions to optimize your Ipers Payout and secure your financial future.

How Can You Maximize Your Retirement Benefits?

Maximizing your Ipers Payout requires strategic planning and informed decision-making. Here are some tips to help you get the most out of your retirement benefits:

- Increase Your Years of Service: The more years you work, the higher your payout will be. Consider extending your career to boost your benefits.

- Boost Your Final Average Salary: Aim to increase your salary during your highest earning years, as this directly impacts your payout.

- Delay Retirement: If possible, delay your retirement to increase your payout. The longer you wait, the higher your monthly benefit will be.

- Utilize Service Credits: Take advantage of additional service credits, such as purchasing credits for military service, to enhance your payout.

- Stay Informed: Regularly review your IPERS account and stay updated on any policy changes that may affect your benefits.

By implementing these strategies, you can maximize your Ipers Payout and ensure a comfortable retirement.

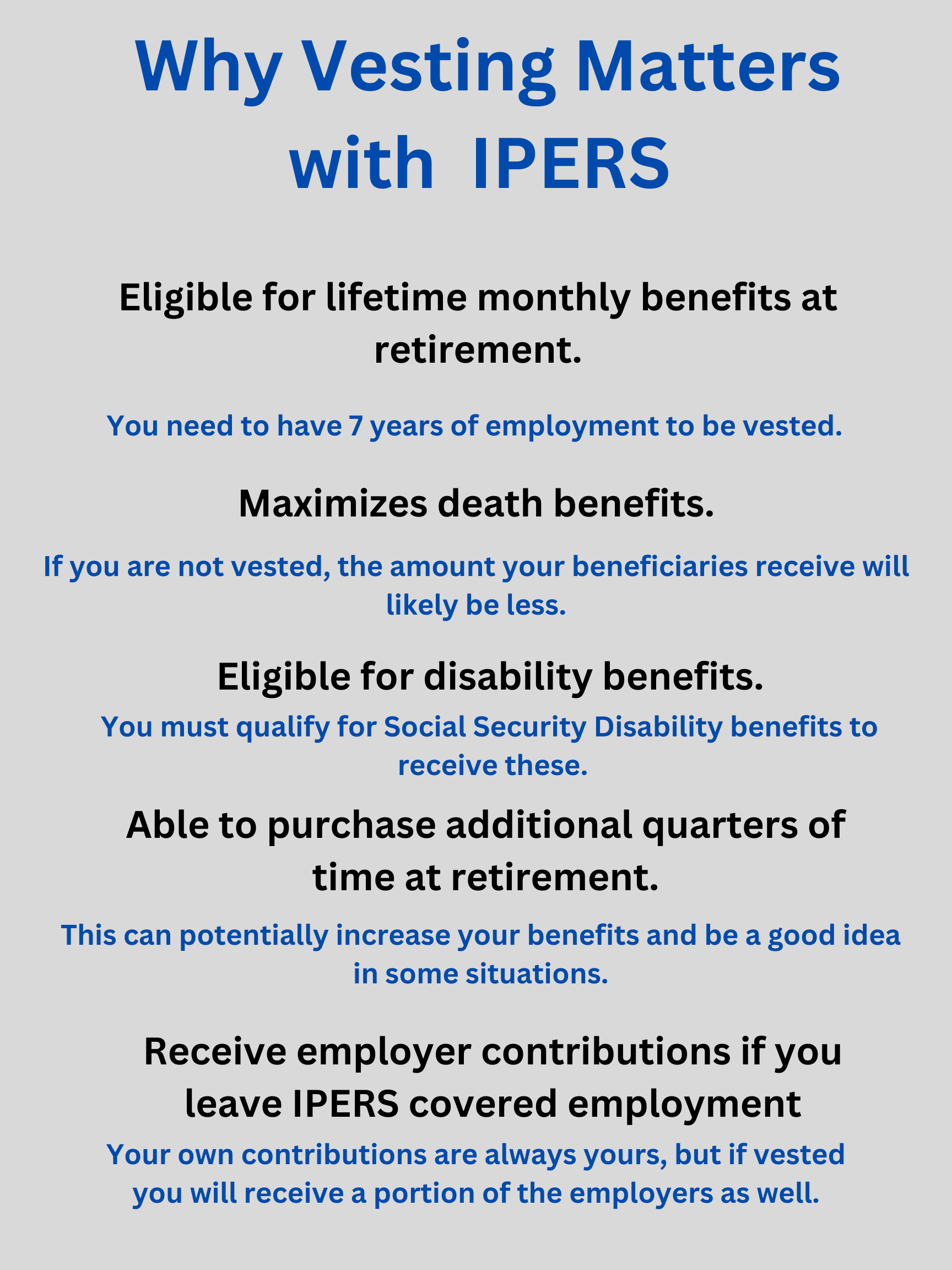

What Are the Benefits of IPERS?

IPERS offers numerous advantages to its participants, providing a secure and reliable source of income during retirement. Some key benefits include:

- Guaranteed Lifetime Income: IPERS provides a consistent monthly payment for life, offering peace of mind and financial stability.

- Cost-of-Living Adjustments (COLAs): Regular adjustments help maintain the purchasing power of your benefits, protecting against inflation.

- Disability and Death Benefits: IPERS offers additional benefits for disability and beneficiary payments, ensuring comprehensive coverage.

- Survivor Benefits: Options are available to provide continued support to your beneficiaries after your passing.

These benefits make IPERS a valuable resource for public employees in Iowa, ensuring a secure and comfortable retirement.

Common Mistakes to Avoid with Ipers Payout

To make the most of your Ipers Payout, it's important to avoid common pitfalls that can impact your retirement benefits. Here are some mistakes to watch out for:

- Early Retirement Without Full Benefits: Retiring early can significantly reduce your monthly payout. Consider working until you qualify for full benefits.

- Neglecting Service Credits: Failing to account for additional service credits, such as military service, can lower your payout.

- Ignoring Policy Changes: IPERS policies can change, affecting your benefits. Stay informed and adjust your plans accordingly.

- Overlooking Survivor Benefits: Ensure your beneficiaries are aware of the options available to them, and update your beneficiary information regularly.

By avoiding these mistakes, you can protect and maximize your Ipers Payout, ensuring a secure retirement.

Comparing IPERS with Other Retirement Plans

When planning for retirement, it's essential to compare IPERS with other available retirement plans. Understanding the differences can help you make informed decisions. Here's how IPERS stacks up against other options:

- Defined Benefit vs. Defined Contribution: Unlike defined contribution plans (e.g., 401(k)s), IPERS guarantees a specific payout, providing more predictability.

- Risk Management: IPERS absorbs investment risk, whereas defined contribution plans place the investment risk on the employee.

- Lifetime Income: IPERS offers a lifetime payout, while defined contribution plans depend on the account balance and withdrawals.

- Employer Contributions: IPERS requires employer contributions, enhancing the fund and potential benefits.

By comparing IPERS with other retirement plans, you can determine the best fit for your financial goals and retirement needs.

How to Apply for IPERS Benefits?

Applying for your Ipers Payout involves several steps to ensure a smooth transition into retirement. Here's a step-by-step guide to help you navigate the process:

- Review Your Account: Check your IPERS account for accuracy, including service credits and beneficiary information.

- Estimate Your Benefits: Use the IPERS calculator or consult with an IPERS representative to estimate your payout.

- Submit Your Application: Complete and submit the IPERS retirement application form, available on their website.

- Choose Your Payment Option: Select the payment option that best suits your needs, such as a single life annuity or joint and survivor annuity.

- Finalize Your Retirement Date: Confirm your retirement date and ensure all necessary paperwork is completed.

By following these steps, you can successfully apply for your Ipers Payout and start enjoying your retirement benefits.

Understanding Ipers Payout Taxes

Ipers Payouts are subject to federal and state taxes, which can impact your net retirement income. Here's what you need to know about taxes on your Ipers Payout:

- Federal Taxes: Ipers Payouts are considered taxable income and are subject to federal income tax. You can choose to have taxes withheld from your payments.

- State Taxes: In Iowa, Ipers Payouts are generally exempt from state income tax, but it's important to verify this with a tax professional.

- Tax Withholding Options: IPERS offers various withholding options to help you manage your tax liability.

Consult with a tax advisor to understand the tax implications of your Ipers Payout and plan accordingly to minimize your tax burden.

Managing Your Ipers Payout After Retirement

Effective management of your Ipers Payout is crucial to ensuring a comfortable and secure retirement. Here are some strategies to help you manage your retirement income:

- Create a Budget: Develop a retirement budget that accounts for your monthly expenses and ensures your payout covers your needs.

- Consider Additional Income Sources: Explore part-time work or other income sources to supplement your Ipers Payout.

- Monitor Your Expenses: Regularly review your spending and adjust your budget as needed to stay within your means.

- Plan for Healthcare Costs: Healthcare expenses can be significant in retirement. Consider options like Medicare and supplemental insurance.

- Stay Informed: Keep up with any changes to IPERS policies or benefits that may affect your payout.

By following these strategies, you can manage your Ipers Payout effectively and enjoy a secure retirement.

Frequently Asked Questions

What is the eligibility requirement for IPERS?

Eligibility for IPERS typically requires employment with an IPERS-covered employer in Iowa, such as a state or local government agency, public school, or other participating public entity. Employees must meet a minimum service period to qualify for retirement benefits.

Can I receive IPERS and Social Security?

Yes, you can receive both IPERS benefits and Social Security. IPERS benefits are independent of Social Security, and receiving one does not affect the other. However, it's important to understand how both systems interact and plan accordingly.

How can I purchase additional service credits?

You can purchase additional service credits, such as for military service, by contacting IPERS directly. They will provide you with the necessary forms and information on costs and payment options.

What happens to my IPERS benefits if I change jobs?

If you change jobs but remain with an IPERS-covered employer, your service credits and benefits continue to accrue. If you leave IPERS-covered employment, you may have options to leave your funds in IPERS, withdraw your contributions, or roll them over to another qualified plan.

How are cost-of-living adjustments (COLAs) determined?

IPERS evaluates the need for cost-of-living adjustments based on various factors, including inflation and the financial health of the fund. Adjustments are not guaranteed annually and are subject to approval by the IPERS Board.

Can I change my payment option after retirement?

Once you select a payment option at retirement, it is generally irrevocable. Carefully consider your choice and consult with an IPERS representative to ensure it aligns with your financial goals and needs.

Conclusion

Understanding and effectively managing your Ipers Payout is key to securing a stable and comfortable retirement. By familiarizing yourself with the intricacies of IPERS, calculating your potential benefits, and implementing strategies to maximize your payout, you can ensure financial security in your golden years. Stay informed, plan ahead, and make the most of the opportunities available to you through the Iowa Public Employees' Retirement System. With careful planning and informed decisions, you can enjoy a fulfilling and worry-free retirement.

.png)