Monzo Bank has emerged as one of the most innovative and customer-centric financial institutions in recent years, redefining how banking works for the digital age. With its user-friendly app, transparent practices, and a commitment to empowering its customers, Monzo Bank has quickly gained a reputation as a trailblazer in the fintech landscape. Whether you're looking for a hassle-free current account, savings options, or innovative money management tools, Monzo Bank has something to offer for everyone.

Founded in 2015, Monzo Bank has become synonymous with convenience and accessibility. As a digital-only bank, it operates without physical branches, allowing users to manage their finances entirely through its mobile app. From instant transaction notifications to budgeting assistance, Monzo Bank provides a seamless experience that appeals to tech-savvy individuals and those seeking modern financial solutions. Its vibrant coral-colored debit card has also become a symbol of its fun yet professional approach to banking.

But what makes Monzo Bank truly stand out? In this article, we'll dive deep into its features, benefits, and how it has transformed banking for millions of users in the UK and beyond. Whether you're considering opening an account or simply curious about its offerings, this guide will provide comprehensive insights into everything Monzo Bank has to offer.

Read also:Harlem Hospital Center A Beacon Of Healthcare Excellence In New York City

Table of Contents

- What is Monzo Bank?

- How Did Monzo Bank Start?

- Features and Services of Monzo Bank

- What Makes Monzo Bank Different?

- How Does Monzo Bank Make Money?

- Monzo Bank and Customer Security

- Does Monzo Bank Charge Fees?

- Monzo Bank Business Accounts: What Do They Offer?

- Personal Loans and Overdrafts at Monzo Bank

- How Does Monzo Bank Promote Financial Inclusion?

- Pros and Cons of Monzo Bank

- How to Open an Account with Monzo Bank?

- Monzo Bank vs. Traditional Banks: Which is Better?

- Frequently Asked Questions

- Conclusion

What is Monzo Bank?

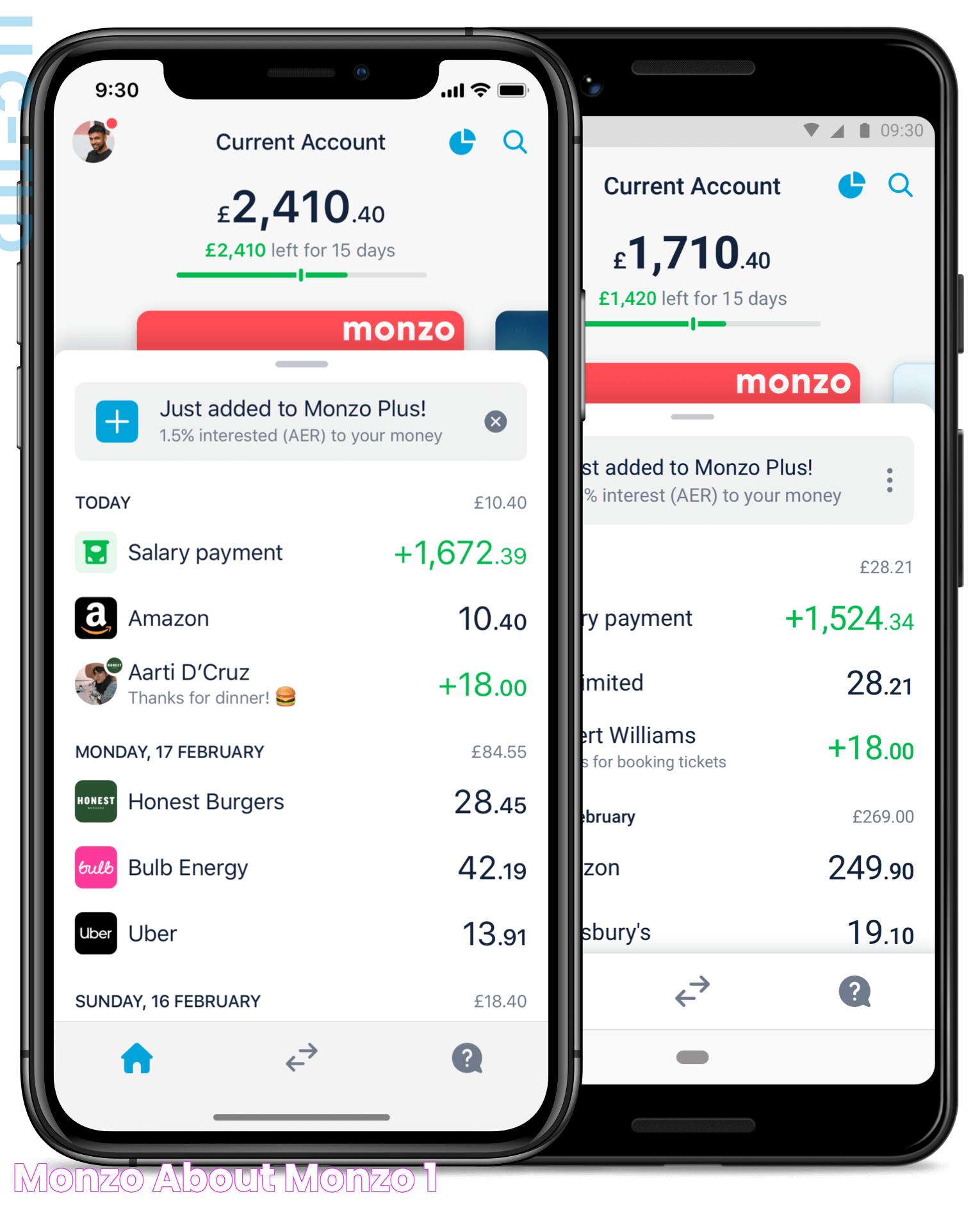

Monzo Bank is a UK-based digital-only bank that operates entirely through a mobile app. It offers a wide range of financial products and services, including current accounts, savings accounts, budgeting tools, and business banking options. Unlike traditional banks, Monzo Bank does not have physical branches, making it highly accessible to users who prefer managing their finances on the go.

Monzo Bank is designed for the modern consumer, providing features like instant spending notifications, fee-free spending abroad, and customizable savings pots. Its mission is to make money management effortless, transparent, and enjoyable for everyone. By leveraging technology, Monzo Bank has been able to streamline banking processes and offer features that traditional banks struggle to match.

How Did Monzo Bank Start?

Monzo Bank was founded in 2015 by a group of fintech entrepreneurs who sought to revolutionize the banking industry. The founders, including Tom Blomfield, Jonas Huckestein, Jason Bates, Paul Rippon, and Gary Dolman, envisioned a bank that prioritized customer needs and leveraged technology to simplify financial management.

Initially launched as Mondo, the company rebranded to Monzo Bank after a successful crowdfunding campaign in 2016. This campaign raised over £1 million in just 96 seconds, showcasing the immense demand for a bank that truly listened to its customers. Since then, Monzo Bank has grown rapidly, attracting millions of users and earning numerous accolades for its innovation and customer-focused approach.

Timeline of Monzo Bank's Growth

- 2015: Monzo Bank is founded as Mondo.

- 2016: Rebrands to Monzo Bank after a record-breaking crowdfunding campaign.

- 2017: Receives a full banking license from the UK Financial Conduct Authority (FCA).

- 2018: Launches overdraft and business banking features.

- 2019: Expands to the US market with a beta version of its app.

- 2020: Introduces premium accounts, including Monzo Plus and Monzo Premium.

Features and Services of Monzo Bank

Monzo Bank offers a comprehensive suite of features and services tailored to meet the needs of individuals, businesses, and families. Here are some of its standout offerings:

1. Current Accounts

Monzo Bank’s current accounts are designed with simplicity and convenience in mind. Users can easily open an account through the app, with no paperwork required. Key features include:

Read also:Why Tight Tacos Kaimuki Is The Ultimate Destination For Flavor Enthusiasts

- Instant spending notifications.

- Fee-free transactions abroad.

- Customizable savings pots.

- Overdraft options.

2. Business Banking

For entrepreneurs and small businesses, Monzo Bank offers business accounts with tools to streamline financial management. These accounts feature:

- Invoicing capabilities.

- Expense tracking.

- Tax calculation assistance.

3. Savings and Investments

Monzo Bank provides users with options to save and grow their money through savings pots and investment partnerships. Features include:

- Customizable savings goals.

- Competitive interest rates.

- Easy access to funds when needed.

4. Budgeting Tools

One of Monzo Bank’s most popular features is its budgeting tools, which help users take control of their finances. These tools include:

- Spending categorization.

- Monthly budget tracking.

- Bill splitting and shared tabs for group expenses.

What Makes Monzo Bank Different?

Monzo Bank stands out from its competitors in several ways:

- It is a customer-first bank, actively seeking feedback to improve its services.

- Its app-based approach makes banking accessible and convenient.

- It offers unique features like salary advances, bill pots, and instant notifications.

How Does Monzo Bank Make Money?

Monzo Bank generates revenue through various channels, including:

- Premium account subscriptions (Monzo Plus and Monzo Premium).

- Overdraft and loan interest.

- Interchange fees from card transactions.

Monzo Bank and Customer Security

Security is a top priority for Monzo Bank. It employs advanced encryption and fraud detection technology to protect customer data. Features like two-factor authentication and instant transaction alerts provide an additional layer of security.

Does Monzo Bank Charge Fees?

Monzo Bank is known for its transparent fee structure. While most of its services are free, certain features like overdrafts and premium accounts come with fees. Users are always informed of any charges upfront, ensuring there are no hidden surprises.

Monzo Bank Business Accounts: What Do They Offer?

Monzo Bank’s business accounts are tailored for entrepreneurs and small businesses. Key features include:

- Free and paid account options.

- Integrated accounting tools.

- Expense and invoice management capabilities.

Personal Loans and Overdrafts at Monzo Bank

Monzo Bank offers flexible personal loans and overdrafts to help users manage their finances. Features include competitive interest rates, transparent terms, and the ability to manage repayments through the app.

How Does Monzo Bank Promote Financial Inclusion?

Monzo Bank is committed to promoting financial inclusion by offering services that are accessible to everyone, regardless of their financial background. It provides fee-free banking, budgeting tools, and financial education resources to help users make informed decisions.

Pros and Cons of Monzo Bank

Here’s a quick overview of the advantages and disadvantages of using Monzo Bank:

Pros

- User-friendly app with innovative features.

- Transparent fee structure.

- Excellent customer support.

Cons

- Limited availability outside the UK.

- No physical branches for in-person assistance.

How to Open an Account with Monzo Bank?

Opening an account with Monzo Bank is quick and easy:

- Download the Monzo app from the App Store or Google Play.

- Provide your personal details and verify your identity.

- Choose the type of account you wish to open.

- Receive your coral-colored debit card in the mail.

Monzo Bank vs. Traditional Banks: Which is Better?

While traditional banks offer a wide range of services and physical branches, Monzo Bank excels in accessibility, innovation, and customer satisfaction. The best option depends on your personal preferences and financial needs.

Frequently Asked Questions

1. Is Monzo Bank safe to use?

Yes, Monzo Bank is regulated by the Financial Conduct Authority (FCA) and offers FSCS protection for deposits up to £85,000.

2. Can I use Monzo Bank abroad?

Yes, Monzo Bank offers fee-free spending abroad, making it a great choice for travelers.

3. Does Monzo Bank offer joint accounts?

Yes, Monzo Bank provides joint accounts for couples and families who want to manage their finances together.

4. What is Monzo Plus?

Monzo Plus is a premium account offering additional features like credit score tracking, virtual cards, and advanced budgeting tools.

5. How long does it take to open a Monzo Bank account?

Opening an account typically takes just a few minutes through the app.

6. Can I deposit cash into my Monzo Bank account?

Yes, you can deposit cash at participating PayPoint locations for a small fee.

Conclusion

Monzo Bank has revolutionized the way we think about banking, offering a seamless, customer-focused experience that embraces technology and innovation. Whether you're looking for a reliable current account, advanced budgeting tools, or business banking solutions, Monzo Bank has something to meet your needs. With its commitment to transparency, security, and financial inclusion, Monzo Bank is undoubtedly a leader in the digital banking revolution.