The Robinhood app has revolutionized the way people invest by making stock trading accessible to everyone, regardless of their financial background. With its intuitive interface, commission-free trades, and wide array of investment options, Robinhood has empowered millions to take charge of their financial futures. In a world where traditional brokerage firms often come with high fees and barriers to entry, Robinhood has broken the mold, democratizing investing for the masses.

Since its inception, the Robinhood app has become a household name, particularly among millennials and Gen Z users. Its mission to "democratize finance for all" resonates deeply in an era where financial literacy is more important than ever. Whether you're looking to trade stocks, explore cryptocurrency, or invest in ETFs, Robinhood offers a seamless and user-friendly experience tailored to both beginners and experienced investors. This innovative platform has sparked a fintech revolution, challenging traditional norms of investing.

In this comprehensive guide, we’ll dive deep into the Robinhood app, exploring its features, benefits, and how it works. We’ll also discuss potential drawbacks, answer common questions, and provide actionable tips to help you make the most of this forward-thinking financial tool. Whether you're a seasoned investor or just dipping your toes into the world of trading, this article will serve as your ultimate resource for understanding and leveraging the Robinhood app.

Read also:Ultimate Guide To Merryvale Winery A Hub For Fine Wines And Unforgettable Experiences

Table of Contents

- What is the Robinhood App?

- How Does the Robinhood App Work?

- Key Features of the Robinhood App

- Is the Robinhood App Safe?

- Benefits of Using the Robinhood App

- Drawbacks of the Robinhood App

- Why is the Robinhood App Popular Among Young Investors?

- Can You Trade Cryptocurrency on the Robinhood App?

- How to Open an Account on the Robinhood App?

- Tips for Maximizing Your Experience on the Robinhood App

- How Does the Robinhood App Make Money?

- Can the Robinhood App Help You Achieve Financial Goals?

- Alternatives to the Robinhood App

- Frequently Asked Questions

- Conclusion

What is the Robinhood App?

The Robinhood app is a financial technology platform designed to make investing simple, affordable, and accessible for everyone. Founded in 2013 by Vladimir Tenev and Baiju Bhatt, Robinhood disrupted the financial industry by eliminating commission fees on trades, a feature that set it apart from traditional brokerage firms. The app allows users to invest in stocks, exchange-traded funds (ETFs), cryptocurrencies, and options without paying hefty trading fees.

Robinhood's mission is rooted in the idea of democratizing finance. By lowering barriers to entry, the app has given people from all walks of life the opportunity to participate in the stock market. Its user-friendly interface, educational resources, and innovative features have made it a go-to choice for novice investors and seasoned traders alike.

Personal Details of the Founders

| Attribute | Details |

|---|---|

| Founder 1 | Vladimir Tenev |

| Founder 2 | Baiju Bhatt |

| Founded | 2013 |

| Headquarters | Menlo Park, California, USA |

How Does the Robinhood App Work?

The Robinhood app simplifies investing by providing a platform where users can buy and sell financial assets directly from their smartphones or desktops. Here's a step-by-step explanation of how it works:

- Sign-Up: Users can easily create an account using their email address and personal information. The app requires verification of identity to comply with financial regulations.

- Funding: Once the account is set up, users can link their bank accounts to deposit funds. Robinhood offers instant deposits to help users start trading right away.

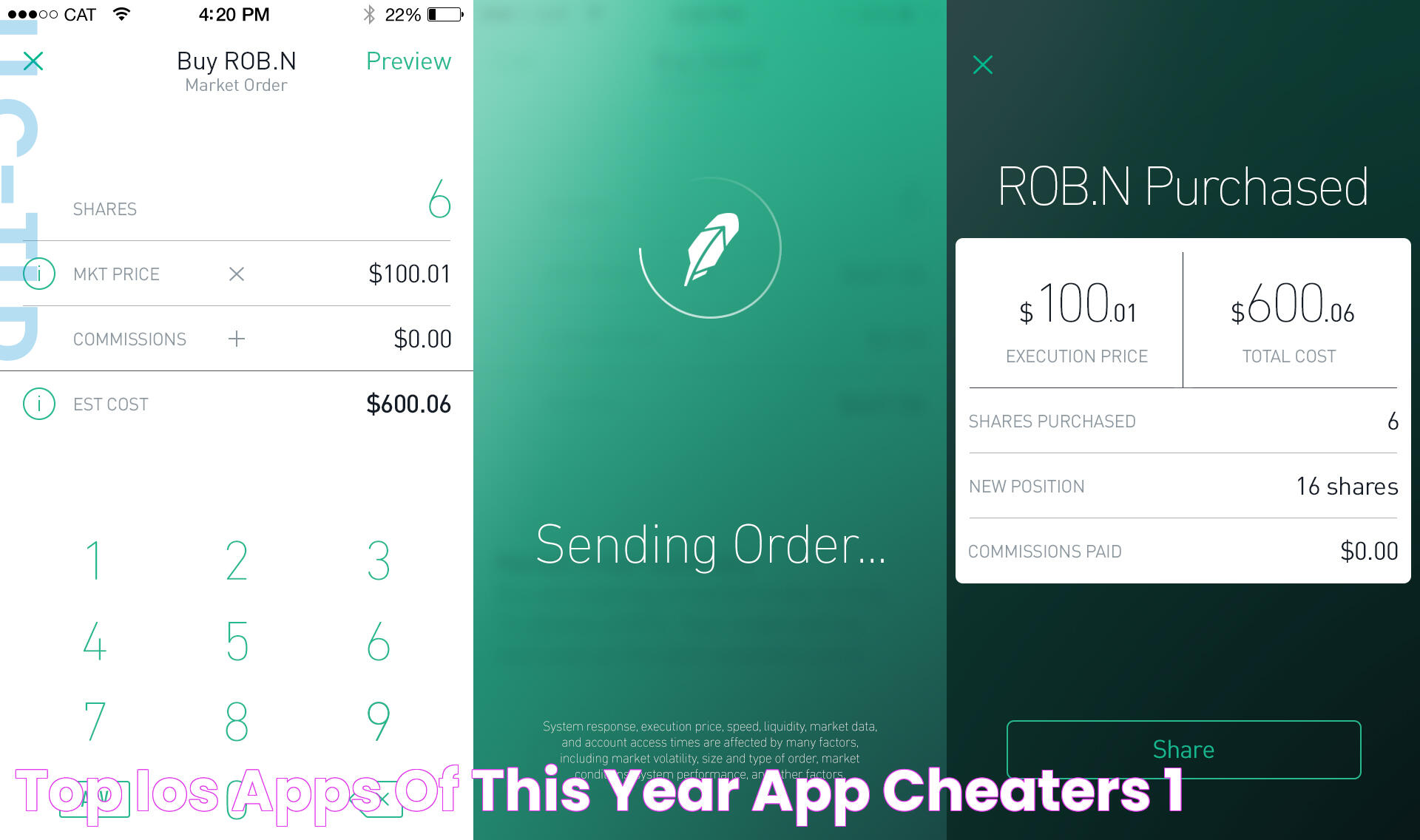

- Trading: After funding the account, users can search for stocks, ETFs, or cryptocurrencies and place orders directly through the app. Robinhood provides market data, charts, and news to assist in decision-making.

- Portfolio Management: The app features a dashboard where users can track their portfolio performance, analyze asset allocation, and monitor market trends in real-time.

Robinhood also offers advanced tools like fractional shares, options trading, and margin accounts, catering to both beginner and advanced investors.

Key Features of the Robinhood App

Robinhood stands out in the crowded fintech space thanks to its innovative features. Below are some of the key features that make the app unique:

- Commission-Free Trading: Users can trade stocks, ETFs, and options without paying any fees.

- Cryptocurrency Trading: The app allows users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

- Fractional Shares: This feature enables users to invest in high-priced stocks with as little as $1.

- Cash Management: Robinhood Cash Card offers a debit card and savings account with competitive interest rates.

- Educational Resources: Robinhood Learn provides tutorials, articles, and videos to educate users about investing basics.

Is the Robinhood App Safe?

Safety and security are top concerns for any financial platform, and Robinhood is no exception. The app employs several security measures to protect user accounts and funds:

Read also:Find The Best Barber Shops Open Late Near Me For Your Convenience

- Encryption: Robinhood uses bank-level encryption to safeguard user data.

- Two-Factor Authentication: Users can enable 2FA for an added layer of security.

- Regulatory Compliance: Robinhood is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which provides insurance for user accounts up to $500,000.

While Robinhood is generally safe, users should remain vigilant about phishing scams and unauthorized access to their accounts.

Benefits of Using the Robinhood App

Robinhood has several advantages that have contributed to its widespread popularity:

- Accessibility: The app is easy to use, even for beginners.

- Cost Efficiency: Commission-free trading saves users money.

- Flexibility: Offers a wide range of investment options, including stocks, ETFs, and cryptocurrencies.

- Transparency: No hidden fees or complicated pricing structures.

Frequently Asked Questions

1. What is the minimum deposit required to open a Robinhood account?

There is no minimum deposit required to open a Robinhood account. Users can start investing with as little as $1.

2. Can I trade international stocks on the Robinhood app?

No, Robinhood currently supports trading only U.S.-listed stocks and ETFs.

3. Does Robinhood charge any hidden fees?

No, Robinhood is transparent about its pricing and does not charge hidden fees. However, regulatory fees may apply for certain transactions.

4. Is Robinhood suitable for day trading?

Yes, Robinhood's commission-free structure makes it appealing for day traders. However, users must comply with the Pattern Day Trader (PDT) rule.

5. Does Robinhood offer educational resources?

Yes, Robinhood Learn provides a variety of educational materials to help users understand investing.

6. Can I transfer my investments from Robinhood to another brokerage?

Yes, but Robinhood charges a $75 fee for outbound account transfers.

Conclusion

The Robinhood app has truly redefined the landscape of investing by making it accessible and affordable for everyone. Whether you're a beginner looking to build your first portfolio or an experienced trader exploring new opportunities, Robinhood offers a platform that caters to all. With its commission-free trades, user-friendly interface, and innovative features, the app continues to be a game-changer in the world of finance.

However, like any financial tool, it's essential to use Robinhood responsibly and educate yourself about the risks involved. By leveraging the app's features and resources, you can take meaningful steps toward achieving your financial goals. So why wait? Take control of your financial future with the Robinhood app today.