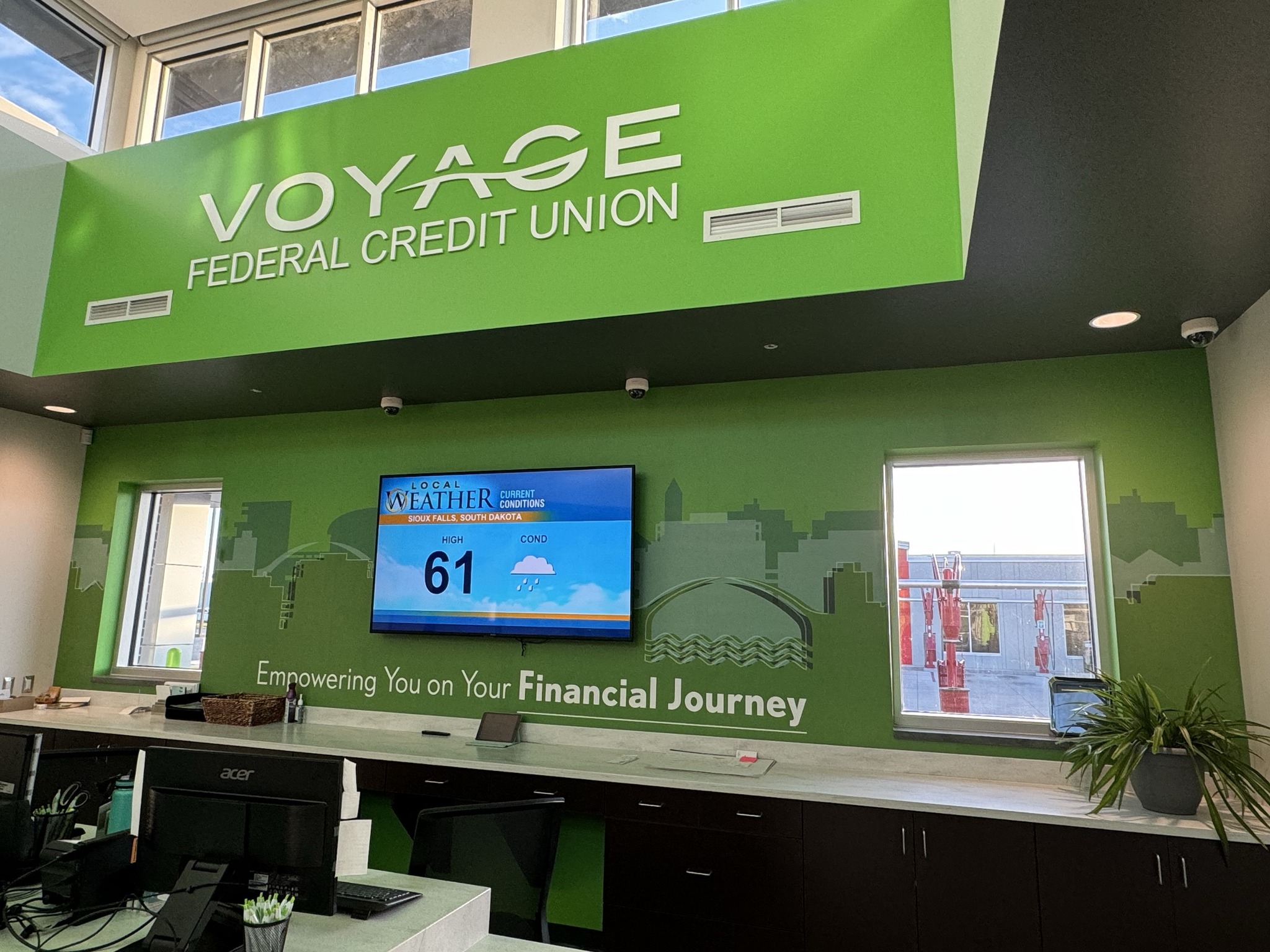

Voyage Federal Credit Union is a member-owned financial cooperative headquartered in Louisville, Kentucky. As of December 2022, Voyage Federal Credit Union had $2.3 billion in assets and served over 160,000 members.

Voyage Federal Credit Union offers a variety of financial products and services, including checking and savings accounts, loans, and credit cards. The credit union also offers a variety of financial education and counseling services.

Voyage Federal Credit Union is committed to providing its members with the best possible financial products and services. The credit union is consistently ranked as one of the top credit unions in the country.

Read also:Jill Bidens Vote Dress A Style Statement With A Powerful Message

Voyage Federal Credit Union

Voyage Federal Credit Union is a member-owned financial cooperative headquartered in Louisville, Kentucky. As of December 2022, Voyage Federal Credit Union had $2.3 billion in assets and served over 160,000 members.

- Financial products

- Financial services

- Financial education

- Financial counseling

- Member-owned

- Community-focused

These key aspects of Voyage Federal Credit Union highlight its commitment to providing its members with the best possible financial products and services. The credit union is consistently ranked as one of the top credit unions in the country.

1. Financial products

Financial products are essential to Voyage Federal Credit Union's ability to serve its members. The credit union offers a wide range of financial products, including checking and savings accounts, loans, and credit cards. These products allow members to manage their finances, save for the future, and borrow money when needed.

Voyage Federal Credit Union's financial products are designed to meet the needs of its members. The credit union offers a variety of checking and savings accounts to fit different needs, including basic checking accounts, interest-bearing checking accounts, and money market accounts. Voyage Federal Credit Union also offers a variety of loans, including personal loans, auto loans, and mortgages. The credit union's credit cards offer competitive interest rates and rewards programs.

Voyage Federal Credit Union's financial products are an important part of the credit union's mission to provide its members with the best possible financial services. The credit union's financial products are affordable, convenient, and designed to meet the needs of its members.

2. Financial services

Financial services are essential to Voyage Federal Credit Union's ability to serve its members. The credit union offers a wide range of financial services, including checking and savings accounts, loans, and credit cards. These services allow members to manage their finances, save for the future, and borrow money when needed.

Read also:Explore The Timeless Elegance Of Old Hickory Buildings

- Checking and savings accounts

Checking and savings accounts are the most basic financial services offered by Voyage Federal Credit Union. Checking accounts allow members to deposit and withdraw money, while savings accounts allow members to save money and earn interest.

- Loans

Voyage Federal Credit Union offers a variety of loans, including personal loans, auto loans, and mortgages. These loans allow members to borrow money for a variety of purposes, such as consolidating debt, purchasing a car, or buying a home.

- Credit cards

Voyage Federal Credit Union offers a variety of credit cards, including rewards cards and balance transfer cards. These credit cards allow members to make purchases and earn rewards or transfer balances from other credit cards.

- Online and mobile banking

Voyage Federal Credit Union offers online and mobile banking services that allow members to manage their finances from anywhere. These services allow members to check their account balances, transfer money, and pay bills.

Voyage Federal Credit Union's financial services are an important part of the credit union's mission to provide its members with the best possible financial experience. The credit union's financial services are affordable, convenient, and designed to meet the needs of its members.

3. Financial Literacy

Financial literacy is the ability to understand and manage your personal finances. It includes budgeting, saving, investing, and planning for the future. Financial literacy is an important part of overall financial well-being and can help you achieve your financial goals.

Voyage Federal Credit Union (VFCU) is committed to providing its members with the financial education they need to make sound financial decisions. VFCU offers a variety of financial education resources, including:

- Financial literacy workshops

- One-on-one financial counseling

- Online financial education resources

VFCU's financial education programs are designed to help members understand their finances, make informed financial decisions, and achieve their financial goals. VFCU's financial education programs are an important part of the credit union's mission to provide its members with the best possible financial experience.

Financial literacy is an essential skill for everyone, regardless of age, income, or financial situation. VFCU's financial education programs can help you improve your financial literacy and achieve your financial goals.

4. Financial counseling

Voyage Federal Credit Union (VFCU) offers financial counseling services to its members. Financial counseling can help members with a variety of financial issues, including budgeting, debt management, and credit repair. VFCU's financial counselors are trained to provide personalized advice and support to help members achieve their financial goals.

Financial counseling is an important component of VFCU's mission to provide its members with the best possible financial experience. VFCU's financial counselors can help members understand their finances, make informed financial decisions, and achieve their financial goals.

If you are a VFCU member and are struggling with your finances, I encourage you to contact VFCU's financial counseling services. VFCU's financial counselors can provide you with the support and guidance you need to improve your financial situation and achieve your financial goals.

5. Member-owned

Voyage Federal Credit Union (VFCU) is a member-owned financial cooperative. This means that VFCU is owned by its members, not by shareholders. VFCU's profits are returned to its members in the form of lower interest rates on loans, higher interest rates on savings accounts, and lower fees.

Being member-owned gives VFCU a unique advantage over other financial institutions. VFCU is able to focus on its members' needs, rather than the needs of shareholders. VFCU is also able to offer its members lower rates and fees because it does not have to pay dividends to shareholders.

VFCU's member-owned status is an important part of its mission to provide its members with the best possible financial experience. VFCU is committed to providing its members with the financial products and services they need to achieve their financial goals.

6. Community-Focused

Voyage Federal Credit Union (VFCU) is committed to giving back to the community. VFCU sponsors a variety of community events and programs, and its employees volunteer their time to support local organizations. VFCU also provides financial education to the community, and it works to promote financial literacy.

VFCU's community-focused approach is evident in its support of local schools. VFCU provides financial education to students, and it supports a variety of school programs. VFCU also partners with local businesses to provide financial literacy programs to employees.

VFCU's community-focused approach is an important part of its mission to provide its members with the best possible financial experience. By giving back to the community, VFCU is helping to create a better financial future for everyone.

Voyage Federal Credit Union FAQs

Find answers to frequently asked questions about Voyage Federal Credit Union (VFCU).

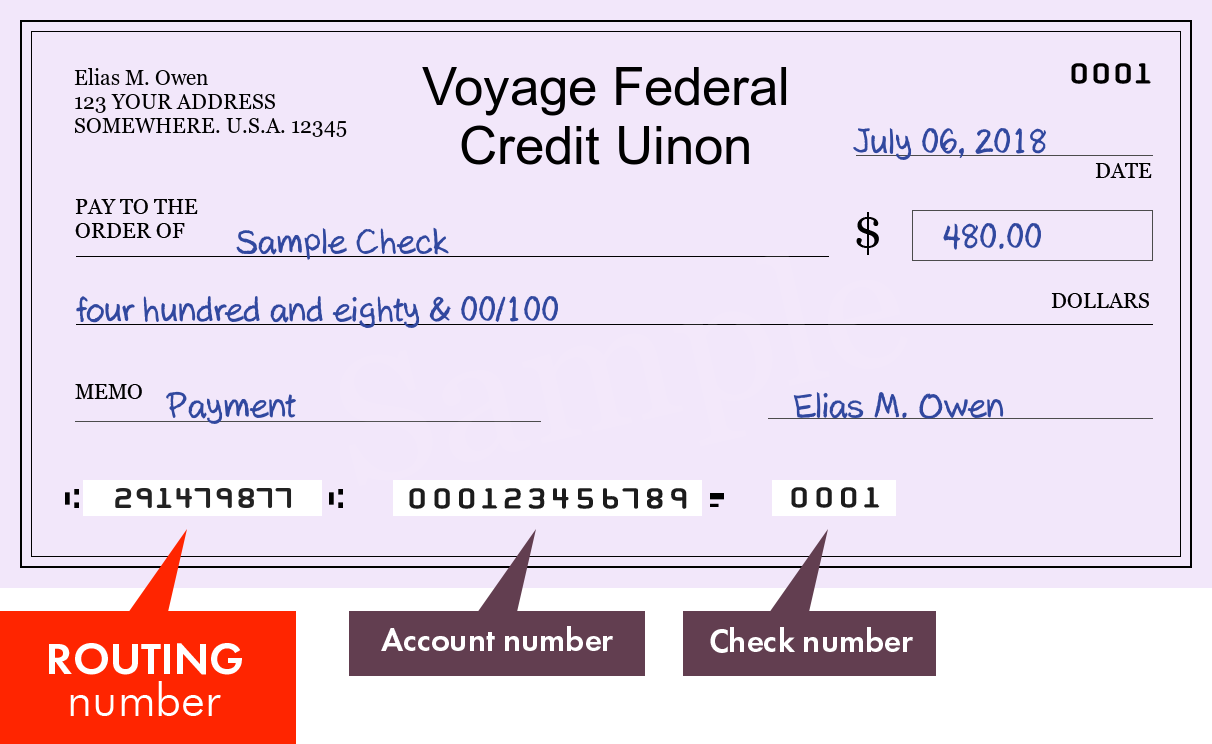

Question 1: What is Voyage Federal Credit Union?Answer: Voyage Federal Credit Union (VFCU) is a member-owned financial cooperative headquartered in Louisville, Kentucky. VFCU offers a variety of financial products and services, including checking and savings accounts, loans, and credit cards.

Question 2: What are the benefits of being a member of VFCU?Answer: Benefits of being a member of VFCU include lower interest rates on loans, higher interest rates on savings accounts, lower fees, and access to a variety of financial products and services.

Question 3: How do I become a member of VFCU?Answer: To become a member of VFCU, you must live, work, worship, or attend school in one of VFCU's eligible counties. You can also become a member if you are a family member of an existing VFCU member.

Question 4: What types of accounts does VFCU offer?Answer: VFCU offers a variety of accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit.

Question 5: What types of loans does VFCU offer?Answer: VFCU offers a variety of loans, including personal loans, auto loans, mortgages, and home equity loans.

Question 6: What types of credit cards does VFCU offer?Answer: VFCU offers a variety of credit cards, including rewards cards, balance transfer cards, and secured credit cards.

For more information about VFCU, please visit VFCU's website or call VFCU at 1-800-884-4328.

Transition to the next article section

Tips from Voyage Federal Credit Union

Voyage Federal Credit Union (VFCU) is a member-owned financial cooperative headquartered in Louisville, Kentucky. VFCU offers a variety of financial products and services, including checking and savings accounts, loans, and credit cards. VFCU is committed to providing its members with the best possible financial experience.

Here are five tips from VFCU to help you improve your financial well-being:

7. 1. Create a budget

A budget is a plan for how you will spend your money. It is an important tool for managing your finances and achieving your financial goals. When you create a budget, you will need to track your income and expenses. Once you know where your money is going, you can make adjustments to your spending habits and save more money.

Example: You can create a budget using a spreadsheet, a budgeting app, or even a piece of paper. Be sure to include all of your income and expenses, and review your budget regularly to make sure that you are on track.

8. 2. Save money

Saving money is important for a variety of reasons. It can help you reach your financial goals, such as buying a house or retiring early. It can also provide you with a financial cushion in case of an emergency.

Example: You can save money by setting up a savings account, contributing to a 401(k) or IRA, or simply putting cash aside each month.

9. 3. Invest your money

Investing is a great way to grow your money over time. There are a variety of investment options available, so it is important to do your research and find the ones that are right for you.

Example: You can invest in stocks, bonds, mutual funds, or ETFs. You can also invest in real estate or other alternative investments.

10. 4. Get out of debt

Debt can be a major financial burden. If you are struggling with debt, there are a number of things you can do to get out of debt and improve your financial situation.

Example: You can consolidate your debt, get a balance transfer credit card, or work with a credit counselor to develop a debt management plan.

11. 5. Improve your credit score

Your credit score is a number that lenders use to assess your creditworthiness. A good credit score can help you qualify for lower interest rates on loans and credit cards. It can also save you money on insurance and other expenses.

Example: You can improve your credit score by paying your bills on time, keeping your credit utilization low, and avoiding new credit inquiries.

By following these tips, you can improve your financial well-being and achieve your financial goals.

Summary of key takeaways or benefits:

- Creating a budget can help you track your income and expenses, and make adjustments to your spending habits.

- Saving money is important for reaching your financial goals and providing you with a financial cushion.

- Investing your money can help you grow your money over time.

- Getting out of debt can improve your financial situation and save you money on interest.

- Improving your credit score can help you qualify for lower interest rates and save you money on insurance and other expenses.

Transition to the article's conclusion:

Improving your financial well-being is not always easy, but it is definitely possible. By following these tips from Voyage Federal Credit Union, you can take control of your finances and achieve your financial goals.

Conclusion

Voyage Federal Credit Union (VFCU) is a member-owned financial cooperative that is committed to providing its members with the best possible financial experience. VFCU offers a variety of financial products and services, including checking and savings accounts, loans, credit cards, and financial education. VFCU is also committed to giving back to the community, and it supports a variety of community events and programs.

If you are looking for a financial institution that is committed to its members and its community, then VFCU is the right choice for you. VFCU offers a variety of financial products and services to meet your needs, and it is always looking for ways to improve the financial well-being of its members. To learn more about VFCU, please visit the VFCU website or call VFCU at 1-800-884-4328.