Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. It offers a range of financial services, including checking and savings accounts, loans, and credit cards. Members Heritage Credit Union is committed to providing its members with competitive rates and low fees, as well as excellent customer service.

Members Heritage Credit Union was founded in 1953 by a group of postal workers in Winston-Salem, North Carolina. The credit union has since grown to become one of the largest credit unions in the United States, with over $5 billion in assets and more than 300,000 members. Members Heritage Credit Union is headquartered in Winston-Salem, North Carolina, and operates branches in North Carolina, South Carolina, and Virginia.

Members Heritage Credit Union is a member-owned financial institution, which means that its profits are returned to its members in the form of lower interest rates on loans, higher interest rates on savings accounts, and lower fees. Members Heritage Credit Union also offers a variety of financial education programs and services to help its members make informed financial decisions.

Read also:Ohio Needs Tim Ryan

members heritage credit union

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. It offers a range of financial services, including checking and savings accounts, loans, and credit cards. Members Heritage Credit Union is committed to providing its members with competitive rates and low fees, as well as excellent customer service.

- Member-owned: Members Heritage Credit Union is owned by its members, which means that its profits are returned to its members in the form of lower interest rates on loans, higher interest rates on savings accounts, and lower fees.

- Not-for-profit: Members Heritage Credit Union is a not-for-profit organization, which means that it does not have to pay taxes on its profits. This allows Members Heritage Credit Union to offer its members lower rates and fees than for-profit banks and credit unions.

- Financial services: Members Heritage Credit Union offers a wide range of financial services, including checking and savings accounts, loans, credit cards, and financial planning services.

- Competitive rates: Members Heritage Credit Union offers competitive rates on its loans and savings accounts. This means that members can save money on interest charges and earn more money on their savings.

- Low fees: Members Heritage Credit Union also offers low fees on its accounts and services. This means that members can keep more of their hard-earned money.

- Excellent customer service: Members Heritage Credit Union is committed to providing its members with excellent customer service. This means that members can expect to be treated with respect and courtesy, and that their needs will be met in a timely and efficient manner.

- Community involvement: Members Heritage Credit Union is actively involved in its community. The credit union supports a variety of local charities and organizations.

These are just a few of the key aspects of Members Heritage Credit Union. The credit union is committed to providing its members with the best possible financial products and services, as well as excellent customer service. Members Heritage Credit Union is a great choice for anyone who is looking for a safe and affordable place to save and borrow money.

1. Member-owned

The fact that Members Heritage Credit Union is member-owned is a key aspect of the credit union's mission and values. As a member-owned credit union, Members Heritage Credit Union is committed to providing its members with the best possible financial products and services. This means that Members Heritage Credit Union offers competitive rates on its loans and savings accounts, as well as low fees on its accounts and services.

One of the most important benefits of being a member of a member-owned credit union is that you have a say in how the credit union is run. Members Heritage Credit Union members elect a board of directors to oversee the credit union's operations. The board of directors is responsible for setting the credit union's policies and procedures, and for ensuring that the credit union is run in a safe and sound manner.

Another benefit of being a member of a member-owned credit union is that you can take advantage of the credit union's profits. Because credit unions are not-for-profit organizations, any profits that the credit union earns are returned to its members in the form of lower interest rates on loans, higher interest rates on savings accounts, and lower fees.

Member-owned credit unions like Members Heritage Credit Union offer a number of advantages over for-profit banks and credit unions. Member-owned credit unions are more likely to offer lower interest rates on loans, higher interest rates on savings accounts, and lower fees. Member-owned credit unions are also more likely to be invested in their communities and to offer a wider range of financial education programs and services.

Read also:Your Local Fix For Mama Rosa Pizza

2. Not-for-profit

The fact that Members Heritage Credit Union is not-for-profit is a key factor in its ability to offer lower rates and fees to its members. For-profit banks and credit unions are required to pay taxes on their profits, which can eat into their bottom line and make it more difficult for them to offer competitive rates to their customers. Members Heritage Credit Union, on the other hand, is able to use its profits to benefit its members in the form of lower rates and fees.

One example of how Members Heritage Credit Union's not-for-profit status benefits its members is in the area of loan rates. Members Heritage Credit Union is able to offer lower interest rates on loans than many for-profit banks and credit unions. This can save members a significant amount of money over the life of a loan.

Another example of how Members Heritage Credit Union's not-for-profit status benefits its members is in the area of fees. Members Heritage Credit Union charges lower fees on its accounts and services than many for-profit banks and credit unions. This can save members money on a monthly basis.

Overall, the fact that Members Heritage Credit Union is not-for-profit is a major benefit to its members. Members Heritage Credit Union is able to use its profits to benefit its members in the form of lower rates and fees, which can save members money over time.

3. Financial services

The financial services offered by Members Heritage Credit Union are a key component of the credit union's mission to provide its members with the best possible financial products and services. The credit union's wide range of financial services allows members to meet all of their financial needs in one place, from everyday banking to long-term financial planning.

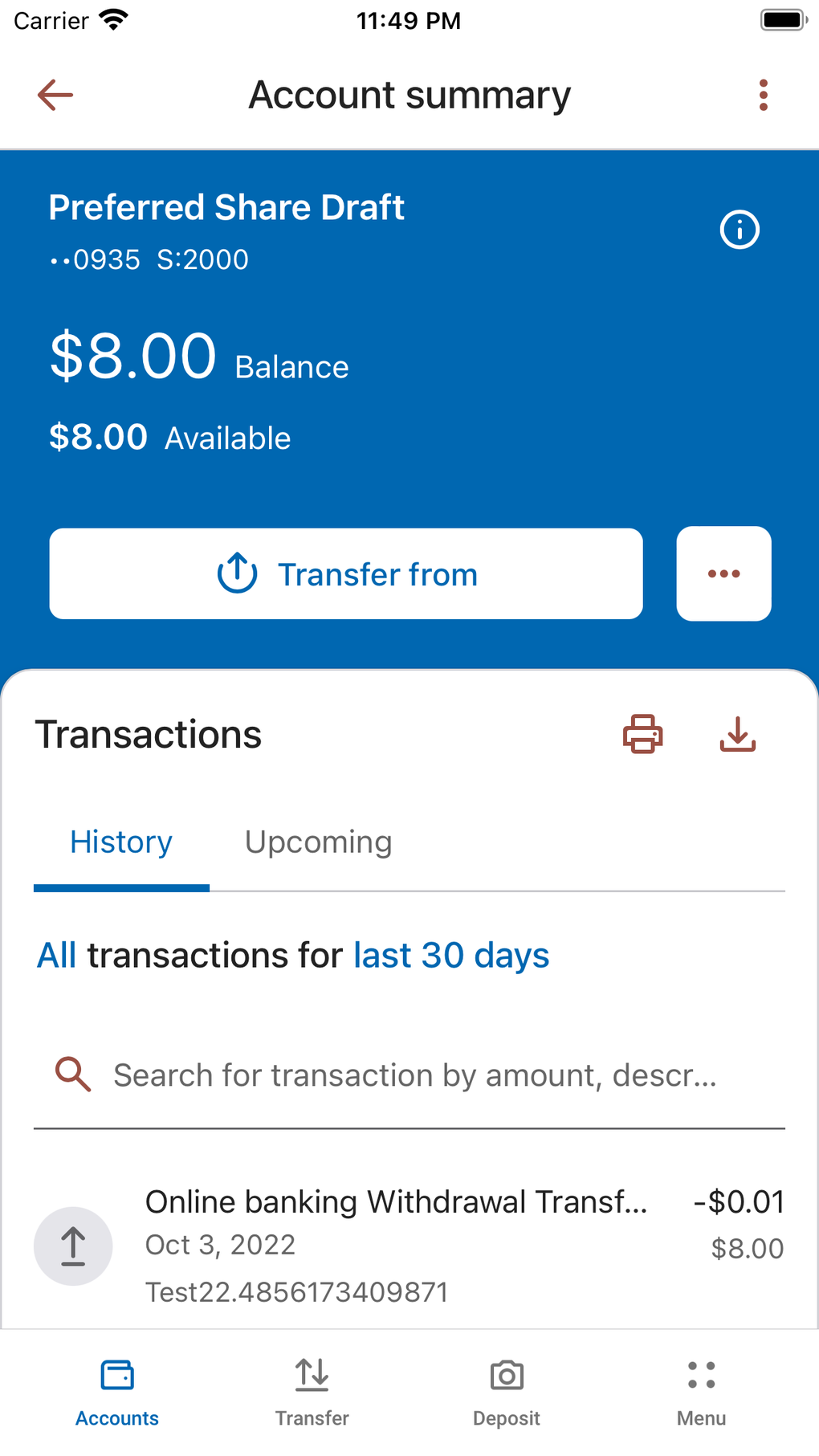

One of the most important financial services that Members Heritage Credit Union offers is checking and savings accounts. Checking accounts allow members to manage their everyday finances, while savings accounts allow members to save money for future goals. Members Heritage Credit Union offers a variety of checking and savings accounts to meet the needs of all members, including basic checking accounts, interest-bearing checking accounts, and high-yield savings accounts.

In addition to checking and savings accounts, Members Heritage Credit Union also offers a variety of loans, including personal loans, auto loans, and mortgages. Members Heritage Credit Union's loans are designed to meet the needs of all members, from those who need a small personal loan to those who need a large mortgage to purchase a home.

Members Heritage Credit Union also offers a variety of credit cards, including rewards credit cards, balance transfer credit cards, and low-interest credit cards. Members Heritage Credit Union's credit cards are designed to meet the needs of all members, from those who want to earn rewards on their everyday purchases to those who need to transfer a balance from a high-interest credit card.

Finally, Members Heritage Credit Union also offers a variety of financial planning services, including retirement planning, investment planning, and estate planning. Members Heritage Credit Union's financial planning services are designed to help members achieve their financial goals, whatever they may be.

The financial services offered by Members Heritage Credit Union are a key part of the credit union's mission to provide its members with the best possible financial products and services. The credit union's wide range of financial services allows members to meet all of their financial needs in one place, from everyday banking to long-term financial planning.

4. Competitive rates

Members Heritage Credit Union is committed to providing its members with the best possible financial products and services. This includes offering competitive rates on its loans and savings accounts. Competitive rates mean that members can save money on interest charges and earn more money on their savings.

There are a number of benefits to getting a loan with a competitive interest rate. First, members can save money on interest charges over the life of the loan. This can be a significant savings, especially for large loans, such as mortgages and auto loans. Second, members can qualify for a lower monthly payment with a competitive interest rate. This can free up cash flow for other expenses or savings goals.

There are also a number of benefits to saving money with a competitive interest rate. First, members can earn more money on their savings over time. This is because the interest earned on savings accounts is compounded, meaning that the interest earned on the initial deposit is also earning interest. Second, members can reach their savings goals faster with a competitive interest rate. This is because the higher interest rate will result in more money being added to the savings account each month.

Overall, getting a loan or saving money with a competitive interest rate can save members money and help them reach their financial goals faster. Members Heritage Credit Union is committed to providing its members with competitive rates on its loans and savings accounts. This is just one of the ways that Members Heritage Credit Union helps its members save money and achieve their financial goals.

5. Low fees

Members Heritage Credit Union is committed to providing its members with the best possible financial products and services. This includes offering low fees on its accounts and services. Low fees mean that members can keep more of their hard-earned money.

- Reduced Expenses: Low fees can help members reduce their monthly expenses. This is because members will not have to pay high fees for basic banking services, such as checking accounts, savings accounts, and debit cards. This can free up more money in members' budgets for other expenses, such as housing, food, and transportation.

- Increased Savings: Low fees can also help members increase their savings. This is because members will have more money left over each month to save. This can help members reach their financial goals faster, such as saving for a down payment on a house or a new car.

- Improved Financial Health: Low fees can also help members improve their overall financial health. This is because members will be able to keep more of their hard-earned money, which can help them reduce debt, build savings, and reach their financial goals.

Overall, low fees are a key part of Members Heritage Credit Union's commitment to providing its members with the best possible financial products and services. Low fees can help members save money, reduce debt, and improve their overall financial health.

6. Excellent customer service

Excellent customer service is a key component of the credit union's mission to provide its members with the best possible financial products and services. Members Heritage Credit Union's commitment to excellent customer service is evident in all aspects of its operations, from the way it interacts with members to the way it resolves complaints.

- Friendly and knowledgeable staff: Members Heritage Credit Union's staff is friendly and knowledgeable, and they are always willing to go the extra mile to help members. This can make a big difference for members, especially when they are dealing with complex financial matters.

- Convenient locations and hours: Members Heritage Credit Union has convenient locations and hours, which makes it easy for members to access their accounts and services. The credit union also offers online and mobile banking, which gives members 24/7 access to their accounts.

- Quick and efficient service: Members Heritage Credit Union is committed to providing quick and efficient service. This means that members can expect to get the help they need quickly and easily.

- Personalized service: Members Heritage Credit Union takes the time to get to know its members and their individual needs. This allows the credit union to provide personalized service that meets the needs of each member.

Members Heritage Credit Union's commitment to excellent customer service is one of the things that sets it apart from other financial institutions. Members Heritage Credit Union is committed to providing its members with the best possible experience, and this is reflected in the way it treats its members.

7. Community involvement

Members Heritage Credit Union is actively involved in its community because it believes that it is important to give back to the community that supports it. The credit union supports a variety of local charities and organizations, including food banks, homeless shelters, and schools. Members Heritage Credit Union also sponsors a number of community events, such as financial literacy workshops and health fairs.

Members Heritage Credit Union's community involvement is a key part of its mission to provide its members with the best possible financial products and services. The credit union believes that by investing in its community, it is investing in its members. When the community is strong, its members are more likely to be financially successful.

There are a number of practical benefits to Members Heritage Credit Union's community involvement. For example, the credit union's support of local food banks helps to ensure that its members have access to affordable food. The credit union's support of homeless shelters helps to provide its members with a safe and stable place to live. And the credit union's support of schools helps to ensure that its members have access to a quality education.

Overall, Members Heritage Credit Union's community involvement is a key part of its commitment to its members. The credit union believes that by investing in its community, it is investing in its members. When the community is strong, its members are more likely to be financially successful.

FAQs about Members Heritage Credit Union

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. It offers a range of financial services, including checking and savings accounts, loans, and credit cards. Members Heritage Credit Union is committed to providing its members with competitive rates and low fees, as well as excellent customer service.

Question 1: What is Members Heritage Credit Union?

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. It offers a range of financial services, including checking and savings accounts, loans, and credit cards.

Question 2: What are the benefits of being a member of Members Heritage Credit Union?

There are many benefits to being a member of Members Heritage Credit Union, including competitive rates on loans and savings accounts, low fees, excellent customer service, and community involvement.

Question 3: How do I become a member of Members Heritage Credit Union?

To become a member of Members Heritage Credit Union, you must live, work, or attend school in the credit union's field of membership. You can also join if you are a family member of an existing member.

Question 4: What is the field of membership for Members Heritage Credit Union?

The field of membership for Members Heritage Credit Union includes residents of Forsyth, Davie, Davidson, Guilford, Randolph, Stokes, Surry, and Yadkin counties in North Carolina.

Question 5: What services does Members Heritage Credit Union offer?

Members Heritage Credit Union offers a range of financial services, including checking and savings accounts, loans, credit cards, and financial planning services.

Question 6: How do I contact Members Heritage Credit Union?

You can contact Members Heritage Credit Union by phone at 1-800-922-4411, by email at [email protected], or by visiting one of the credit union's branches.

Summary

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. It offers a range of financial services, including checking and savings accounts, loans, and credit cards. Members Heritage Credit Union is committed to providing its members with competitive rates and low fees, as well as excellent customer service.

Transition to the next article section

To learn more about Members Heritage Credit Union, please visit the credit union's website at www.membersheritage.org.

Tips from Members Heritage Credit Union

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. The credit union offers a range of financial products and services, including checking and savings accounts, loans, credit cards, and financial planning services. Members Heritage Credit Union is committed to providing its members with competitive rates, low fees, and excellent customer service.

Tip 1: Take advantage of compound interest. Compound interest is the interest that is earned on the initial deposit plus the interest that has been earned in previous periods. This means that your money can grow faster over time. To take advantage of compound interest, make sure to leave your money in a savings account or other investment account for as long as possible.

Tip 2: Pay yourself first. One of the best ways to save money is to pay yourself first. This means setting aside a certain amount of money each month and putting it into a savings account or other investment account. Even if it is just a small amount, it will add up over time.

Tip 3: Create a budget. A budget is a plan for how you will spend your money. Creating a budget can help you track your income and expenses, and make sure that you are not spending more money than you earn. There are many different budgeting tools available, so find one that works for you and stick to it.

Tip 4: Avoid impulse purchases. Impulse purchases are purchases that you make without thinking about them first. These purchases can often be expensive and unnecessary. To avoid impulse purchases, make a list of what you need before you go shopping, and stick to your list. Also, try to wait 24 hours before making a purchase on anything that costs more than a certain amount.

Tip 5: Shop around for the best deals. Before you make a purchase, take some time to shop around and compare prices. This can help you save money on everything from groceries to cars. There are many different ways to shop around, so find one that works for you.

Tip 6: Take advantage of free financial resources. There are many free financial resources available, such as budgeting tools, financial planning calculators, and credit counseling. These resources can help you make informed financial decisions and improve your financial health.

Tip 7: Get help if you need it. If you are struggling to manage your finances, don't be afraid to get help. There are many resources available, such as credit counseling and financial planning services. Getting help can put you on the path to financial success.

By following these tips, you can improve your financial health and reach your financial goals.

Conclusion

Members Heritage Credit Union is committed to providing its members with the tools and resources they need to achieve financial success. By taking advantage of the tips above, you can make the most of your membership and reach your financial goals.

Conclusion

Members Heritage Credit Union is a not-for-profit financial cooperative owned by its members. The credit union offers a range of financial products and services, including checking and savings accounts, loans, credit cards, and financial planning services. Members Heritage Credit Union is committed to providing its members with competitive rates, low fees, and excellent customer service.

Members Heritage Credit Union is a great option for anyone who is looking for a safe and affordable place to save and borrow money. The credit union's commitment to its members is evident in everything it does, from the products and services it offers to the way it treats its members. If you are looking for a financial institution that will put your needs first, Members Heritage Credit Union is the right choice for you.

.png)